by Alpha | Jun 11, 2018 | Business, Market Update, Technology, Trade Ideas, Trading

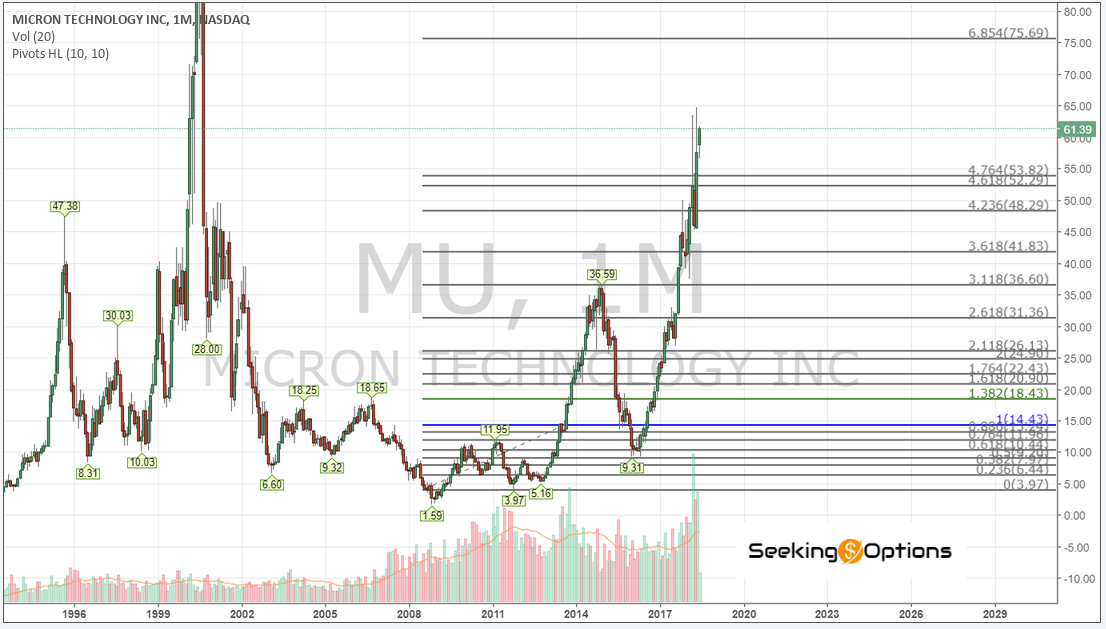

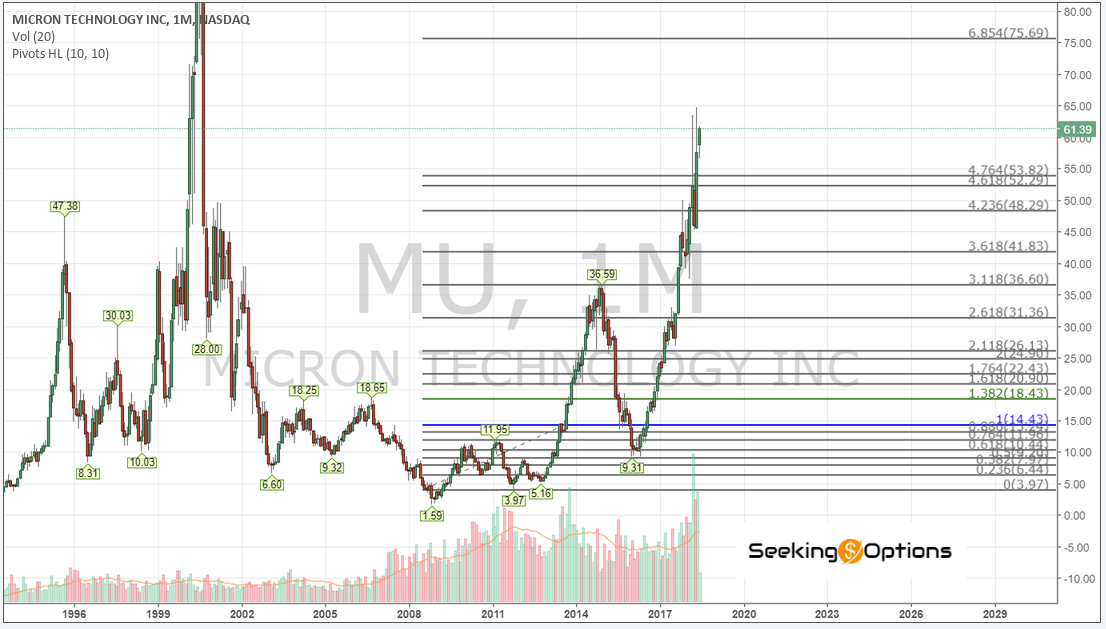

We have been trading $MU, and its been one of our major stocks that we look for higher prices, looking for this slippery wave count on the 15 minutes chart on A6M shown at chart below:

the 5th wave points to the 3.618 extension at 67 area, in case we see 65.96 should be good to reduce. The subdivisions on A5M

have the 2.618 extension at 67.70. Joel has the top of the daily cian channel at 70. Necessary support to hold on the micro is 60.46/60.03 right now. Going deeper into the monthly counts on A4M

$MU been in a 3rd wave that has for ideal target the 2.618 at 93.65, we can see that 1.618 on this monthly count is at 66.17, this is the reason MU been experiencing all this consolidation. This monthly approach has not opposition with others macro counts like the ones on A3M :

that has a limitation at 75.69, being this number the 6.854 extension in this count.

All in all based on analysis and our approach MU has potential to go to 75.69 with solid resistance at 76.06. Once/if MU hits these levels I will update support between 61.83 and 53.82, being the average at 57.82. We are afar from that yet.

We could trade the 75 levels with options, but don’t think that we should use the regular exposure of shares chasing that area.

Have a nice week

We have few trades placed taken in our chat room, also please note that earning is on June 20

by Alpha | Mar 17, 2018 | IKE, Trade Ideas, Trading

SPX Credit Spread Trade

We know its already march but we promised to post our final results for 2017 $SPX Credit spread, a trade that we dearly love to take in our Group, lead by our super IKE.

If you are someone who is busy and not able to trade all the time, this trade can help you add income to your portfolio, you place the order and set it as a good to close order in place. We did have to adjust 2 times last year but that was no issue, just like any other trade.

2017 year was another solid year for Seeking Options team, and the $SPX Trade alone have had 28 winning trades from total 30 that’s 93% win Rate, we had 8 adjustments and 2 losses. Total Net results were 86% Profit, So if you risk 2K per trade (initial Investment) you would have netted by year end 1,717$ USD almost DOUBLE!.

Congratulation on your investments and trades!!

And thanks for being part of Seeking Options Team!!

If you wish to participate in the SPX Credit spread trade, you can click on this link

Did you know that Trading 1 Contract in the past two months would have netted a $760 in Profits i.e it covers the cost for one year and more of the VIP Membership – Which includes access to all services (includes SPX Credit Spreads.)

by IKE | Aug 3, 2016 | IKE, Market Update, Trading

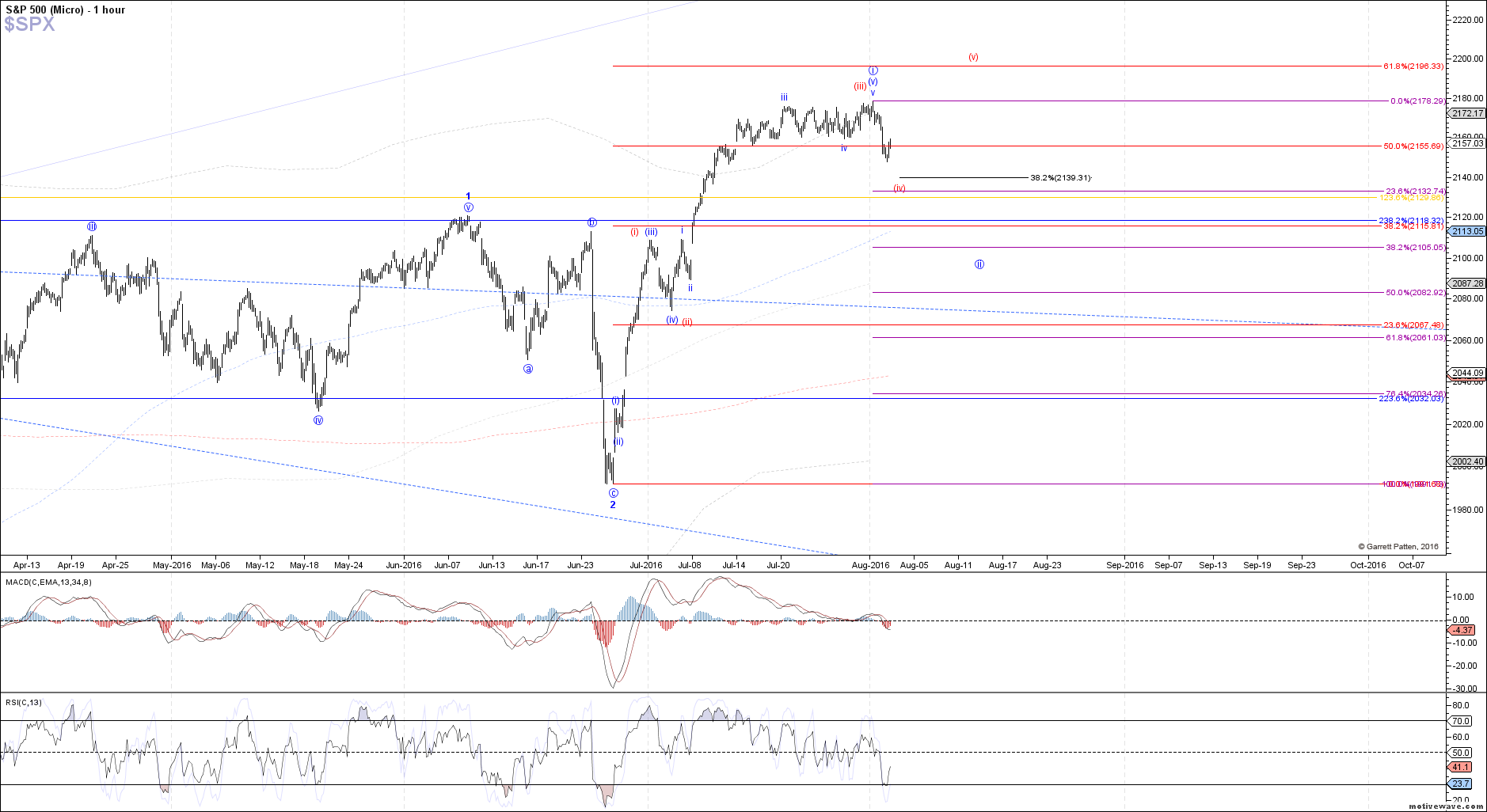

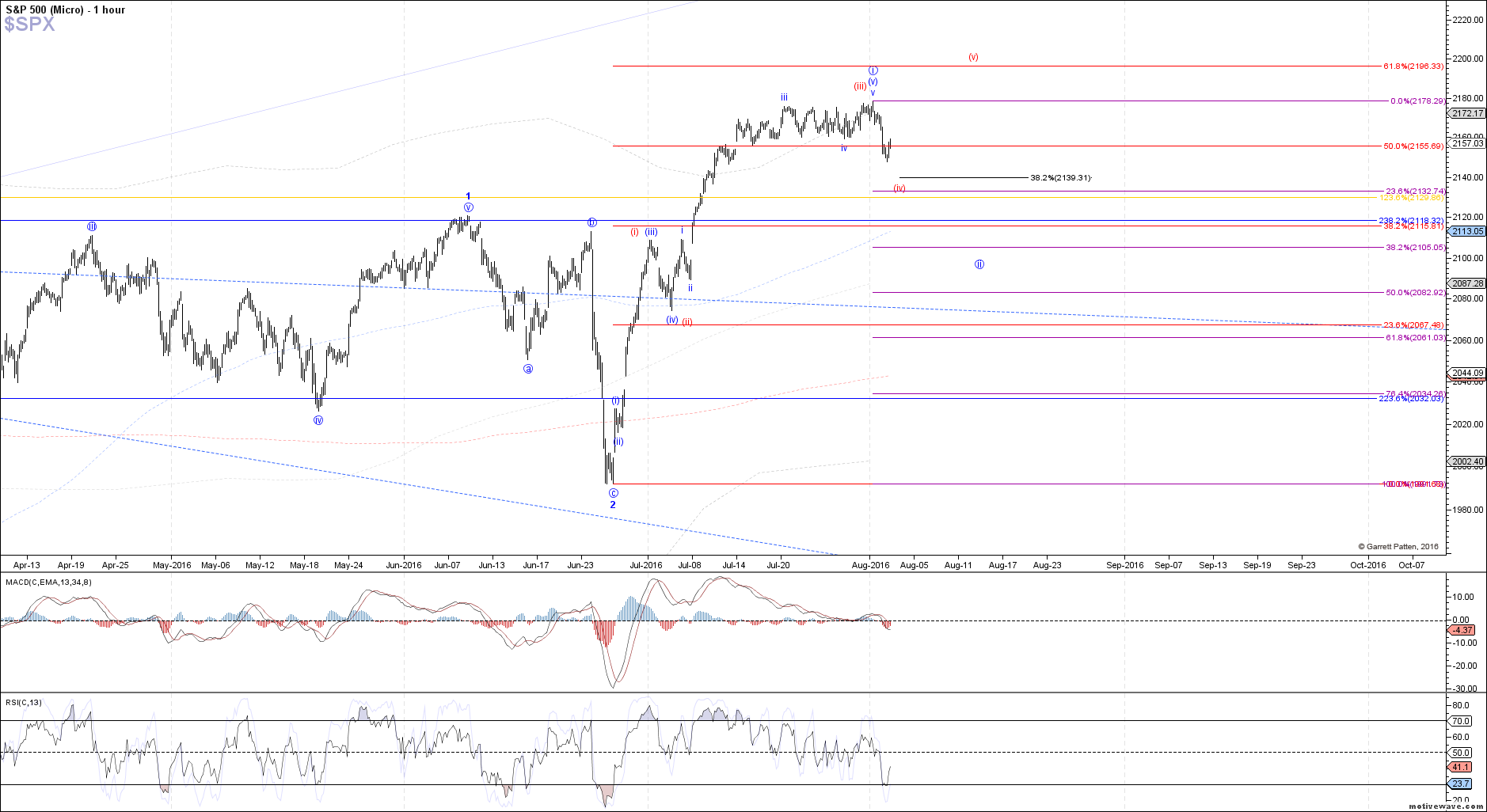

Futures are trading slightly down this morning, but otherwise well above yesterday’s low still. Since we have a potential micro 5 waves up off yesterday’s low, there is a setup for possible upside today, either as part of a corrective bounce or even the start of red wave (v) targeting a new local high. 2163 – 2166.50 SPX is the next resistance above if we do see a move higher today, otherwise a break below yesterday’s low should lead to at least a test of the 2139 $SPX support below for red wave (iv).

Longer term Weekly OB as is Daily so momos say lower. VV AD = .75, Razz no sync

30 Minute Chart for $ES_F

$SPX 1 hour Micro view

To Recap:

Weekly Trend Bull Over Bought: A multi-week high should be at or near completion.

Daily Trend Bear: With today’s daily DTosc BearRev in the oscillator range, a multi-day, if not multi-week high should be near completion, if not complete yesterday.

Morning 15m minute ES trade 60m Bull, 15 Bear n o sync for this trade

Today’s Economic Calendar

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Gallup U.S. Job Creation Index

8:30 Treasury Refunding Quarterly Announcement

9:45 PMI Services Index

10:00 ISM Non-Manufacturing Index

10:30 EIA Petroleum Inventories

For more update, please visit us in our chat room ..

Good Luck Trading..