We have been trading $MU, and its been one of our major stocks that we look for higher prices, looking for this slippery wave count on the 15 minutes chart on A6M shown at chart below:

the 5th wave points to the 3.618 extension at 67 area, in case we see 65.96 should be good to reduce. The subdivisions on A5M

have the 2.618 extension at 67.70. Joel has the top of the daily cian channel at 70. Necessary support to hold on the micro is 60.46/60.03 right now. Going deeper into the monthly counts on A4M

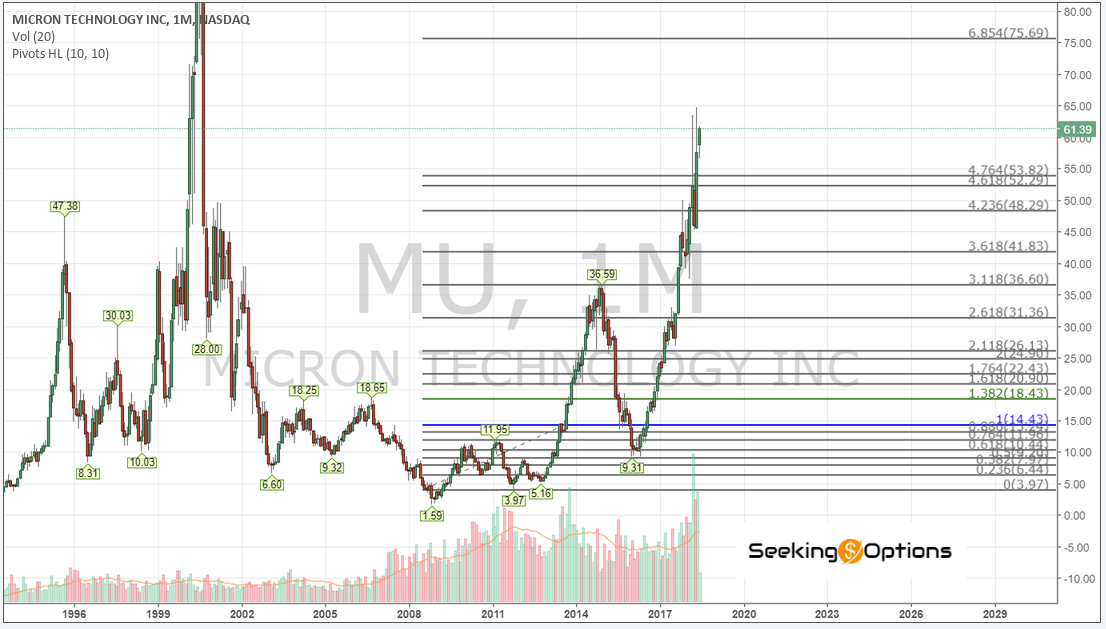

$MU been in a 3rd wave that has for ideal target the 2.618 at 93.65, we can see that 1.618 on this monthly count is at 66.17, this is the reason MU been experiencing all this consolidation. This monthly approach has not opposition with others macro counts like the ones on A3M :

that has a limitation at 75.69, being this number the 6.854 extension in this count.

All in all based on analysis and our approach MU has potential to go to 75.69 with solid resistance at 76.06. Once/if MU hits these levels I will update support between 61.83 and 53.82, being the average at 57.82. We are afar from that yet.

We could trade the 75 levels with options, but don’t think that we should use the regular exposure of shares chasing that area.

Have a nice week

We have few trades placed taken in our chat room, also please note that earning is on June 20