$SPX, $AAPL, $NFLX, $IWM, $QQQ, For june 5th 2019 | #FinTwit, #Trades

Timing is everything

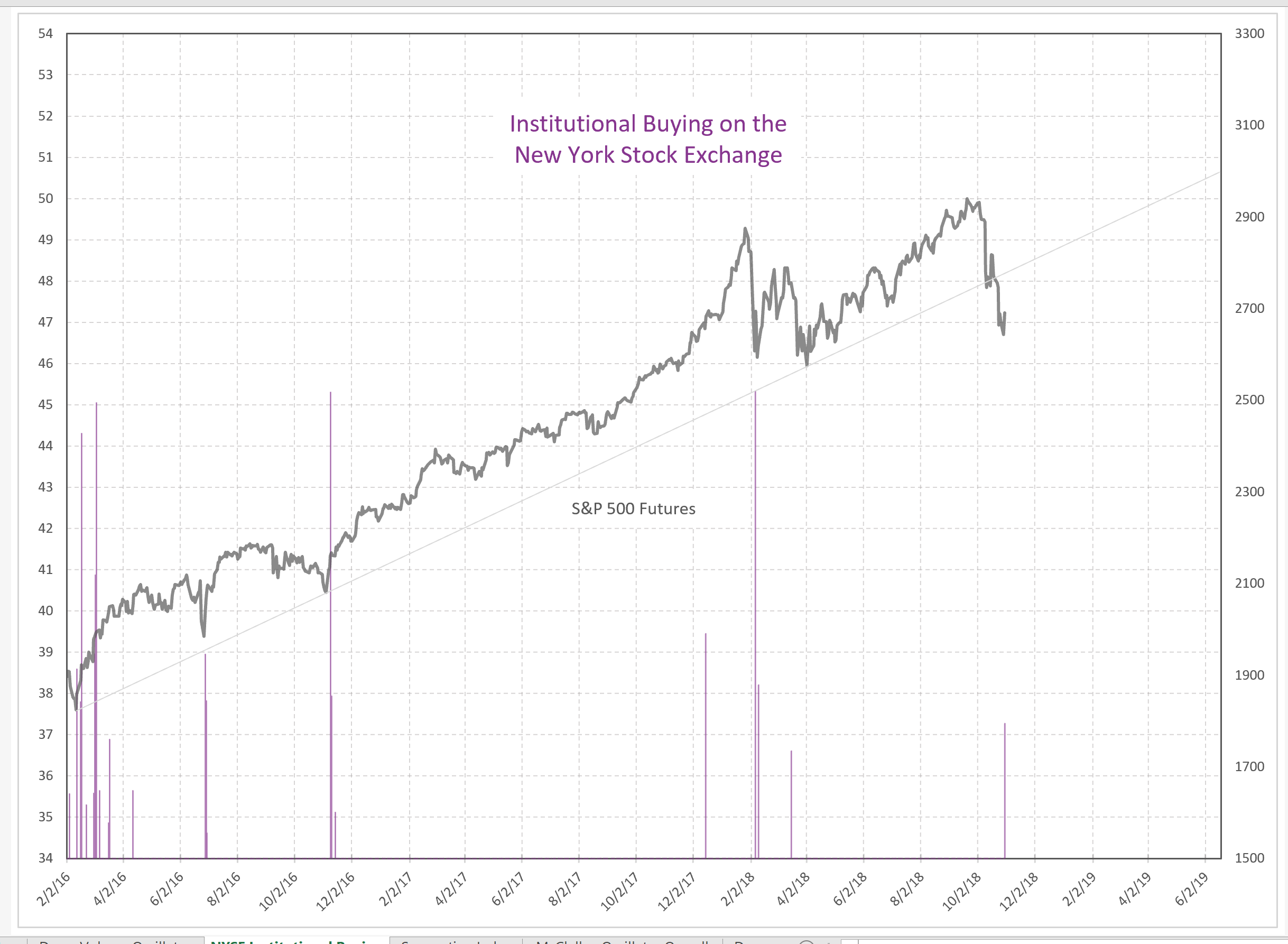

At the moment most traders were looking for a breakout above 2950, we certainly had priced this level as a toxic line. Timing is everything, having a mental stop loss is always needed, and a hard stop at a critical area, will preserve capital. Going to the top of a tower requires a harness. Does not matter how effective is our system, a mental or a hard stop is needed, if we can not price properly a stop loss or the stop loss is too wide, probably the instrument being analyzed should not be traded. Most importantly, once a trader has verified that a line is lethal or toxic, he should stay away and give enough time, a month or two month, for the pressure that resides in that line be released and a new tradable pattern can appear.

This a critical area. In other time or years ago, I could have set 2720 as a target and considered it as a secure level based on the opinion constructed on the indicators we track. But now we demand more from markets and there are some elements for a pullback tomorrow.

SPX, support should be 2787, below this level, the high struck today was a B/1 up with next standard retrace at 2779 (MPlink). The .764 of the move off 2728 is at 2753. In case the market opens at 2833, tha only should complete the red five.

IWM, scarcely broke below 149 today, no change, below 148 next dependable retrace is 146.42 the .764. (IWMlink). Above 149 there is resistance at 142.04. In case IWM opens at 152 that should complete the 5th of C up.

QQQ, three waves up off the lows at 176.83 (QQQalt9link). . The two stocks that participated more were AAPL, NFLX and FB.

AAPL still can see a corrective retrace toward 178.

FB has a critical weekly structure.

NFLX has broken some resistance, might print five up at 362.

AMZN, held support at 1717 this morning

Stocks

NIO, not lower lows today. Next support at 2.41.

IQ, not structures for a bottom yet.

TWLO, consolidation above 128.47 bodes well for TWLO, could be traded with protection versus this level, with a decent target at 153. Have always liked TWLO, and while above 128.47 should be an outperformer (EW1link).

SHAK, rejected at 1.382 but holding the 57 line which is critical for further advance to 82 (EW1link).

BYND, reports tomorrow, might develop an abc to 92 with some support at 88 (EW3link).

SFIX, has a problem with the 2.118 extension in this case 30.32, if truly bullish stop should be 29.88 preparing for 40.20 or new highs on this stock (EW1link).

Good Luck..

Seeking Options Team – RQLAB Please email us if you want to be part of this group at [email protected]

Again we will give more detailed trade setups and targets, please check us our Chat Room..as low as 15 dollars.. check this link for options

Access to the Trade of the Week Click Here

SeekingOptions.com its partners and/or 3rd party affiliates are in open entry/closing positions in all of the above stocks, options, or other forms of equities. The trades provided in the above daily/weekly watchlist are simulations based on SeekingOptions oscillators strictly for educational purposes only, and not to solicit any stock , option or other form of equity. Under Section 202(a)(11)(A)-(E) of the Advisers Act this information is not considered investment or portfolio advisement from an authorized broker registered by the S.EC. (Securities Exchange Committee) and is limited to the scope of education in the form of market commentary through simulated trades via SeekingOptions.com indicators, and other educational tools.

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Use of any of this information is entirely at your own risk, for which SeekingOptions.com will not be liable. Neither we nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness or suitability of the information and content found or offered in the material for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude liability for any such inaccuracies or errors to the fullest extent permitted by law. All information exists for nothing other than entertainment and general educational purposes. We are not registered trading advisors. SeekingOptions.com is not a registered investment Advisor or Broker/Dealer. TRADE AT YOUR OWN RISK