by Alpha | Jul 16, 2018 | Market Update, RQLAB

$SPX and $QQQ Updates:

Moores’ 2C-P is at 69.3

Weekly Expiration, constructed by Joel Withun, is looking positive for the week ending on July 20th . Experience has demonstrated that when we have serious overbought conditions combined with positive projections, the only sector that can move consistently higher is $NDX,where reality can triumph conjectures.

On Joel’s daily chart, 362 is at 2838 for $SPX and for $QQQ 362 is 182.39; stochastics continue being excessively high. Values are similar to 162 extensions on Weekly chart.

Weekly volatility inverted is very overbought. Volatility daily has hit the upper bollinger band in all the three instruments we follow.

Weekly stochastics favor $NVDA, $VT and $AXP; $BIDU looks better than $BABA using weekly stochastic.

EW analysis

The $QQQ ETF has now support at 173.77 (Chart shown)

and many of our $QQQ holdings hit support during last correction, companies like $BABA, $HTHT, $IQ, $BIDU, $NVDA, $TWTR, $AAPL, corrected to their respective support areas, In this regard, I think that if you are planning to go long in overbought conditions we have to suggest $QQQ as the instrument of your consideration.

If you are thinking $AMZN has more room to go before our ideal entries, you should do well by considering stops just below 1810/1790.

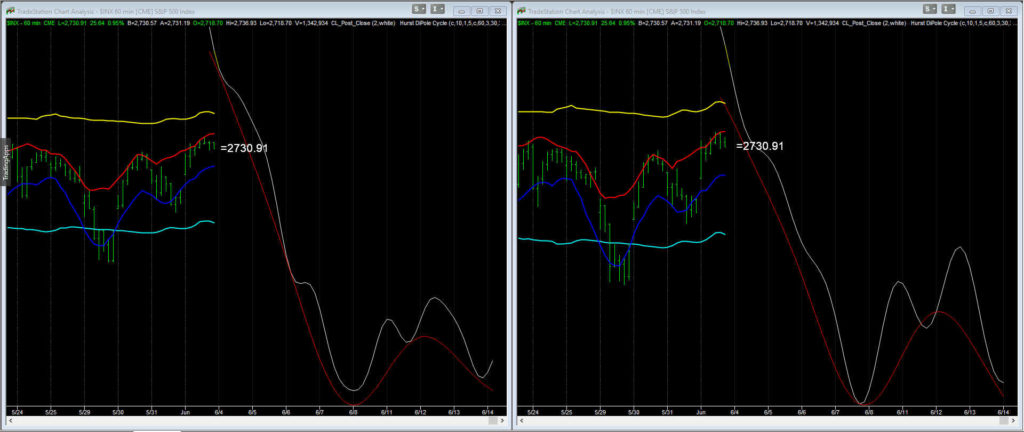

When you compare $SPX chart

to $QQQ

you can see why we are suggesting $QQQ longs; the 3rd wave already was ignited on $QQQ and while we could see a pullback, this should be shallower than on $SPX which still needs work to confirm a breakout above the range.

Trade Well and Good luck

Our last report from one of our portfolio (LINK)

Again we will give more detailed trade setups and targets, please check us our Chat Room..as low as 15 dollars.. check this link for options

Access to the Trade of the Week Click Here

Seeking Options Team – RQLAB Please email us if you want to be part of this group at [email protected]

SeekingOptions.com its partners and/or 3rd party affiliates are in open entry/closing positions in all of the above stocks, options, or other forms of equities. The trades provided in the above daily/weekly watchlist are simulations based on SeekingOptions oscillators strictly for educational purposes only, and not to solicit any stock , option or other form of equity. Under Section 202(a)(11)(A)-(E) of the Advisers Act this information is not considered investment or portfolio advisement from an authorized broker registered by the S.EC. (Securities Exchange Committee) and is limited to the scope of education in the form of market commentary through simulated trades via SeekingOptions.com indicators, and other educational tools.

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Use of any of this information is entirely at your own risk, for which SeekingOptions.com will not be liable. Neither we nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness or suitability of the information and content found or offered in the material for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude liability for any such inaccuracies or errors to the fullest extent permitted by law. All information exists for nothing other than entertainment and general educational purposes. We are not registered trading advisors. SeekingOptions.com is not a registered investment Advisor or Broker/Dealer. TRADE AT YOUR OWN RISK

by Alpha | Jul 13, 2018 | Market Update, RQLAB

$SPX, daily Bigalow: July 12th, $SPX daily bigalow, 8 EMA at 2768 and 50 MA at 2734.12. 50 DMA, Very consistent with .618 retrace

Daily stochastics are overbought in all the indexes.

On $SPX McClellan chart; advance/decline ratio and McClellan oscillator are at the highs. Summation is not easy for interpretation, but looks life five up off the recent lows. For NDX McClellan Chart, oscillator and advance/decline ratio has started to reset, indicating that prices are not extending organically anymore, without organic growth trading the long side is not a winning strategy, but a losing game.

Daily Volatility: VIX Inverted says we could see that hit to 2822.8, but VXV/VIX and VIX/VXST, are not allowing more upside. Joel Has 162 extension at 2810 for tomorrow on $SPX and for $QQQ 162 is at 181.34.

OI: we do remind you that we had a “high” projected for this Friday, July 13th, based on weekly razz constructed by Joel Withun, additionally, the expiration for tomorrow has a positive projection. After this week, we have lower projections at least until July 27th, based on current OI.

Only $TSLA, $YY, $HTHT and partially $BABA have low stochastics. All our other holdings are very high in stochastics terms, not very good longs to chase. We need a reset on $NFLX before earnings.

We still think we have higher levels to see on $QQQ, probably for 195 as secure target, but not from right here. We should see a pullback to 171 before that occurs.

Trade Well and Good luck

Our last report from one of our portfolio (LINK)

Again we will give more detailed trade setups and targets, please check us our Chat Room..as low as 15 dollars.. check this link for options

Access to the Trade of the Week Click Here

Seeking Options Team – RQLAB Please email us if you want to be part of this group at [email protected]

SeekingOptions.com its partners and/or 3rd party affiliates are in open entry/closing positions in all of the above stocks, options, or other forms of equities. The trades provided in the above daily/weekly watchlist are simulations based on SeekingOptions oscillators strictly for educational purposes only, and not to solicit any stock , option or other form of equity. Under Section 202(a)(11)(A)-(E) of the Advisers Act this information is not considered investment or portfolio advisement from an authorized broker registered by the S.EC. (Securities Exchange Committee) and is limited to the scope of education in the form of market commentary through simulated trades via SeekingOptions.com indicators, and other educational tools.

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Use of any of this information is entirely at your own risk, for which SeekingOptions.com will not be liable. Neither we nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness or suitability of the information and content found or offered in the material for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude liability for any such inaccuracies or errors to the fullest extent permitted by law. All information exists for nothing other than entertainment and general educational purposes. We are not registered trading advisors. SeekingOptions.com is not a registered investment Advisor or Broker/Dealer. TRADE AT YOUR OWN RISK

by Alpha | Jul 12, 2018 | Market Update, Portfolio, RQLAB, Trade Ideas

Market still making higher lows and looking to break the recent high, Strength in Quality stocks and Leaders helping the move in the market, patience and money management is important in this business.. In any case we haven’t changed our outlook, and here is an update on some of the instruments that we have in our portfolios that we support.

AMZN; Still have room to see higher targets of 1771 and pushing the limits a bit; 1787. Notice: we are using moon phases.

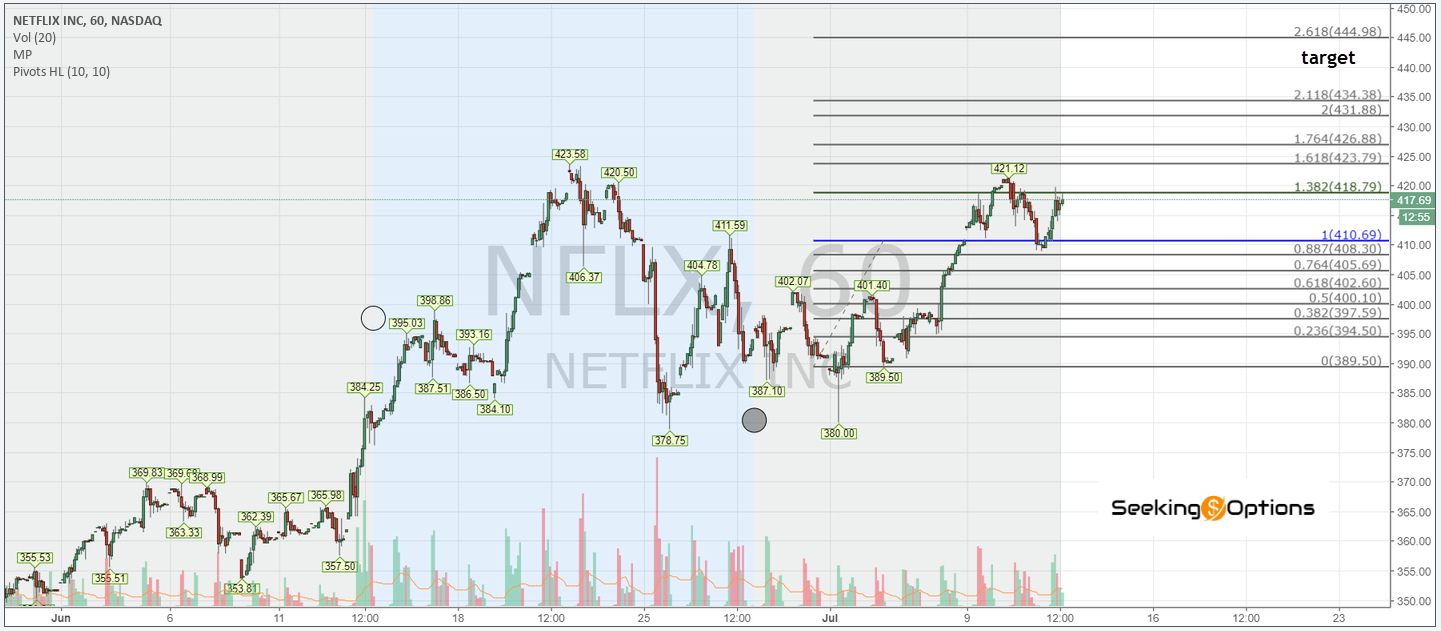

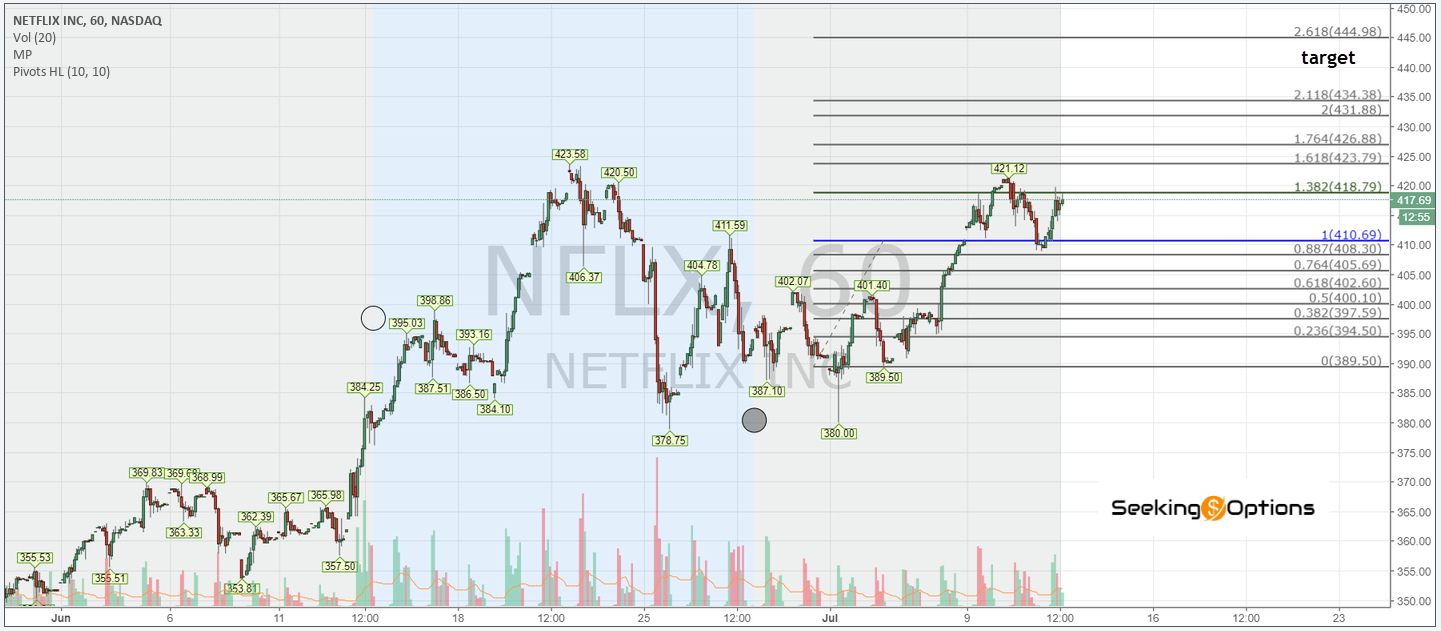

NFLX, reports next week (see chart below). Being conservative and emphasizing the word conservative, ideally should see 444 and we must be out at that level.

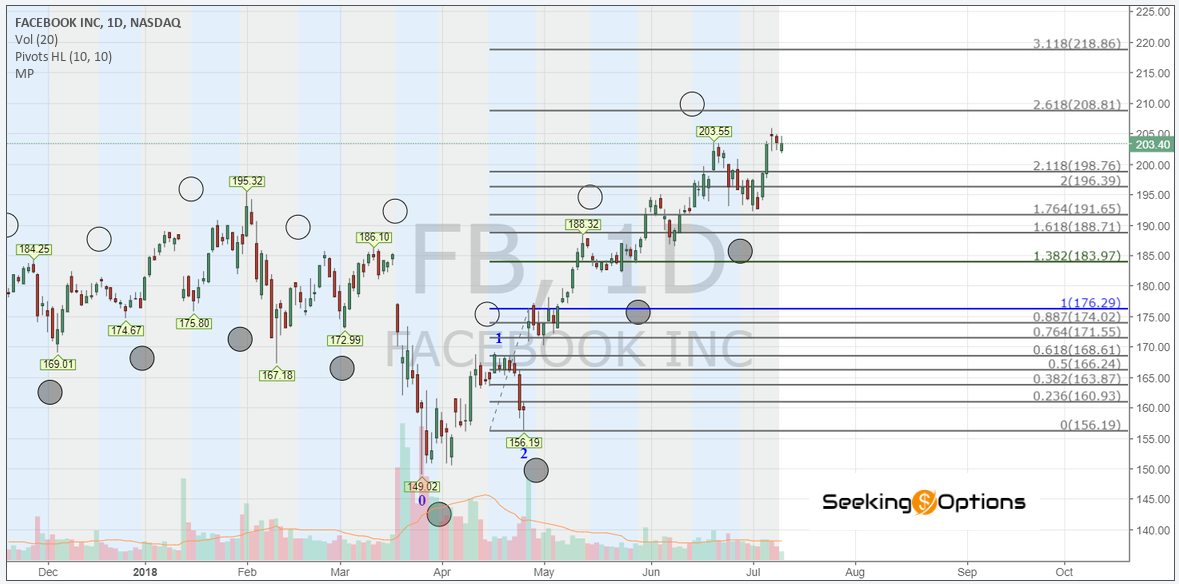

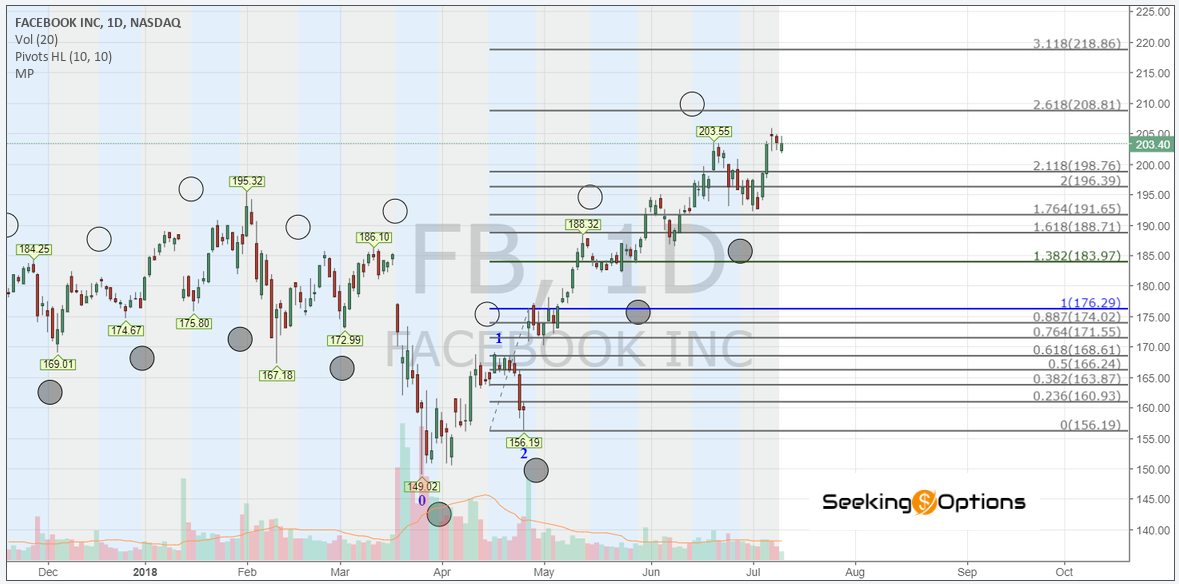

FB should go for 208/209 (See Chart Below); some aggressive extensions to 212 are probable.

GOOGL: M-line at 1090 for support check the monthly chart

we will move minimum-immediate target for $GOOGL to 1280

and we will focus on 1509.41 for the completion of two counts: One on OPL where this 1509 area is 4.236 retrace and the other is what I present here where is 2.618 retrace on AltC layout.

Oil/USO: Holding the Wolverine line (shown in chart below), but looking more like the completion of the 5th of C at 1.382 retrace. Needs below 13 to confirm that will test buyable supports at 11.96, we know how oil behaves so until highs are cleared a deep pullback is possible, support starts at 11.96 and ends at 9.5.

AMZN and GOOGL stochastics still have room for higher, while NFLX is already at the highs, and any gap up, will be sold very soon if not immediately.

Check our last report from one of our portfolio (LINK)

Again we will give more detailed trade setups and targets, please check us our Chat Room..as low as 15 dollars.. check this link for options

Access to the Trade of the Week Click Here

Seeking Options Team – RQLAB Please email us if you want to be part of this group at [email protected]

SeekingOptions.com its partners and/or 3rd party affiliates are in open entry/closing positions in all of the above stocks, options, or other forms of equities. The trades provided in the above daily/weekly watchlist are simulations based on SeekingOptions oscillators strictly for educational purposes only, and not to solicit any stock , option or other form of equity. Under Section 202(a)(11)(A)-(E) of the Advisers Act this information is not considered investment or portfolio advisement from an authorized broker registered by the S.EC. (Securities Exchange Committee) and is limited to the scope of education in the form of market commentary through simulated trades via SeekingOptions.com indicators, and other educational tools.

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Use of any of this information is entirely at your own risk, for which SeekingOptions.com will not be liable. Neither we nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness or suitability of the information and content found or offered in the material for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude liability for any such inaccuracies or errors to the fullest extent permitted by law. All information exists for nothing other than entertainment and general educational purposes. We are not registered trading advisors. SeekingOptions.com is not a registered investment Advisor or Broker/Dealer. TRADE AT YOUR OWN RISK

by Alpha | Jul 2, 2018 | Market Update, RQLAB, Trade Ideas

Stock Market started the week on the low side on increasing Tariff pressure, however we are still finding some great buy spots and here are some of the things are looking in our Portfolio.

$AMD buy signal; $AMZN buy; $BIDU, buy signal; $FB, nothing; $GOOGL buy signal; $HTHT buy signal, $NFLX nothing, $NVDA, buy signal, $TSLA, continue previous buy signal, $XLK buy signal, $YY, nothing.

RSI 5 system buy signals on all 4 indexes.

Indexes stochastic monthly, of all them TNA looks compromised at the highs, but still could go higher and test previous highs on Stoch, $NDX is showing a positive signal on the monthly stochastics with $SPX.

Monthly Volatility is good enough to start a move up on indexes, daily inverted charts are oversold enough to justify a consistent move up across the board.

2C-p = 29.2 (35.9 previous) 6/29/2018 close.

Bottom spotter has made a positive turn

Yield Curve: As long as it says normal, I’m not worried. When it changes to “flat”, then we should start paying attention.

Have a nice week

We have few trades placed taken in our chat room

by Alpha | Jun 11, 2018 | Business, Market Update, Technology, Trade Ideas, Trading

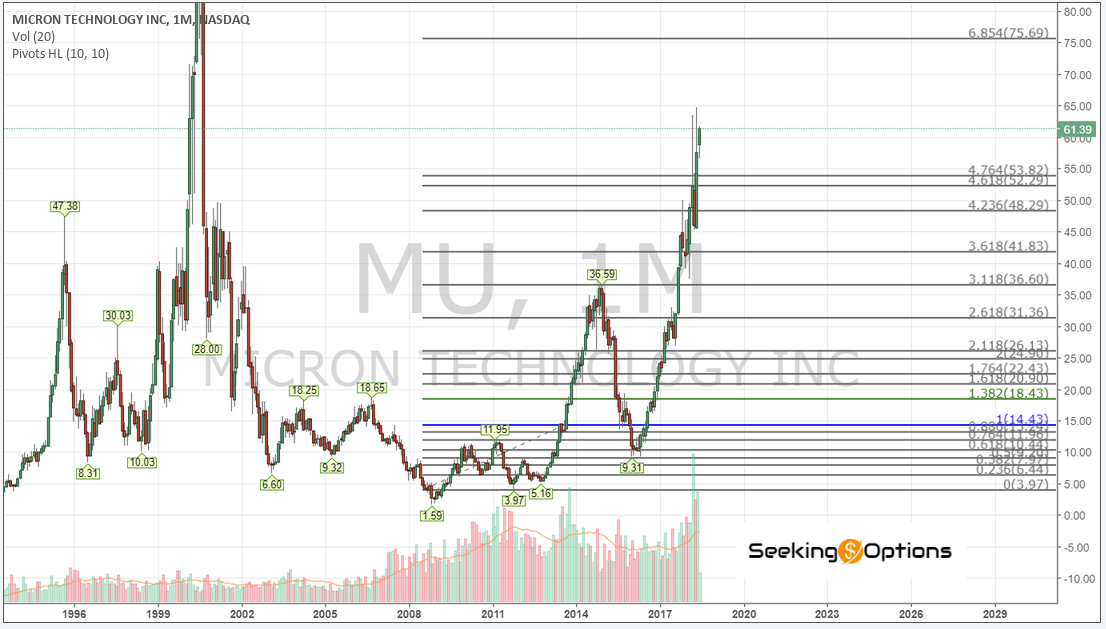

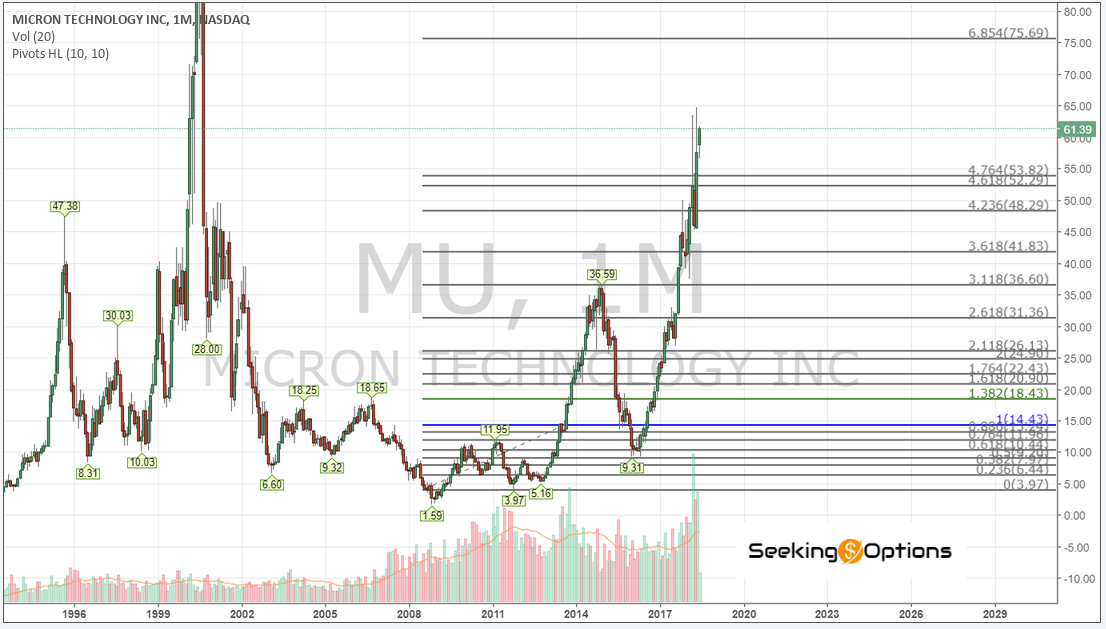

We have been trading $MU, and its been one of our major stocks that we look for higher prices, looking for this slippery wave count on the 15 minutes chart on A6M shown at chart below:

the 5th wave points to the 3.618 extension at 67 area, in case we see 65.96 should be good to reduce. The subdivisions on A5M

have the 2.618 extension at 67.70. Joel has the top of the daily cian channel at 70. Necessary support to hold on the micro is 60.46/60.03 right now. Going deeper into the monthly counts on A4M

$MU been in a 3rd wave that has for ideal target the 2.618 at 93.65, we can see that 1.618 on this monthly count is at 66.17, this is the reason MU been experiencing all this consolidation. This monthly approach has not opposition with others macro counts like the ones on A3M :

that has a limitation at 75.69, being this number the 6.854 extension in this count.

All in all based on analysis and our approach MU has potential to go to 75.69 with solid resistance at 76.06. Once/if MU hits these levels I will update support between 61.83 and 53.82, being the average at 57.82. We are afar from that yet.

We could trade the 75 levels with options, but don’t think that we should use the regular exposure of shares chasing that area.

Have a nice week

We have few trades placed taken in our chat room, also please note that earning is on June 20

by Alpha | Jun 5, 2018 | Market Update, RQLAB

SPX/QQQ

A good start to June with some new money, but it was a Friday. Futures were higher from the open of trade with great Jobs report, holding a fairly tight range into the actual jobs report. The President tweeted a couple of hours ahead of the release that he was looking forward to the numbers, and that was interpreted as an indication they would be good. Leaving all that Fun aside, lets look at market mechanics.

OI and our EW indicator are indicating a significant divergence into next week, so it is our duty to monitor sentiment versus Open Interest in order to make correct decisions.

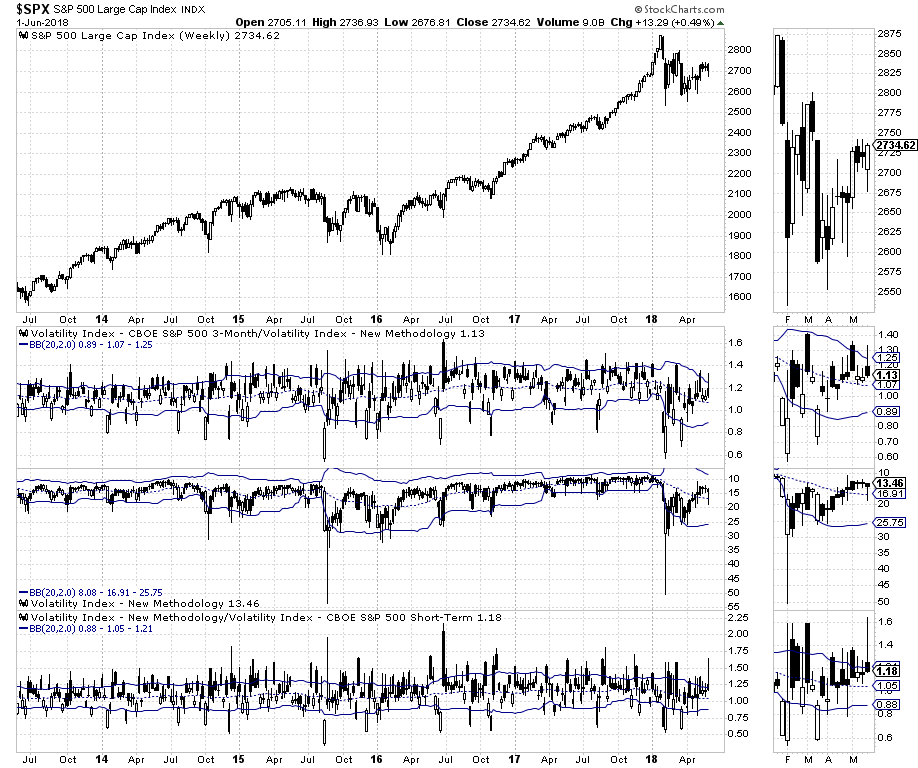

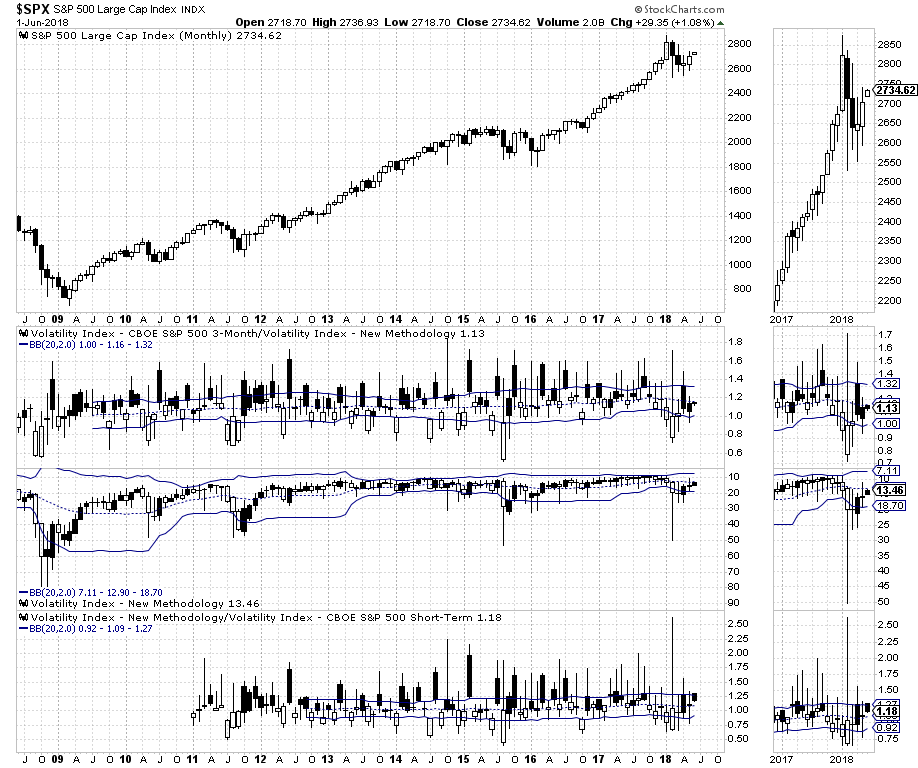

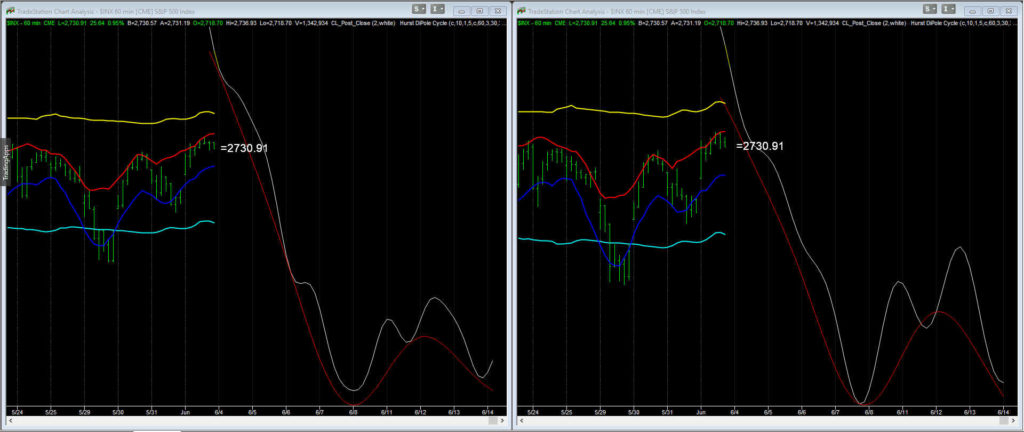

First: The spike we had been expecting, concluded last week as we can observe on the attached weekly chart elaborated by Joel Withun. This same weekly chart is now indicating downside at least until June 15th, Put Call Ration, is at 2.064 so projection is valid based on our experience. Opposing to this is the fact that expiration for this Week is positive when compared to EOW1, up in a moderate fashion.

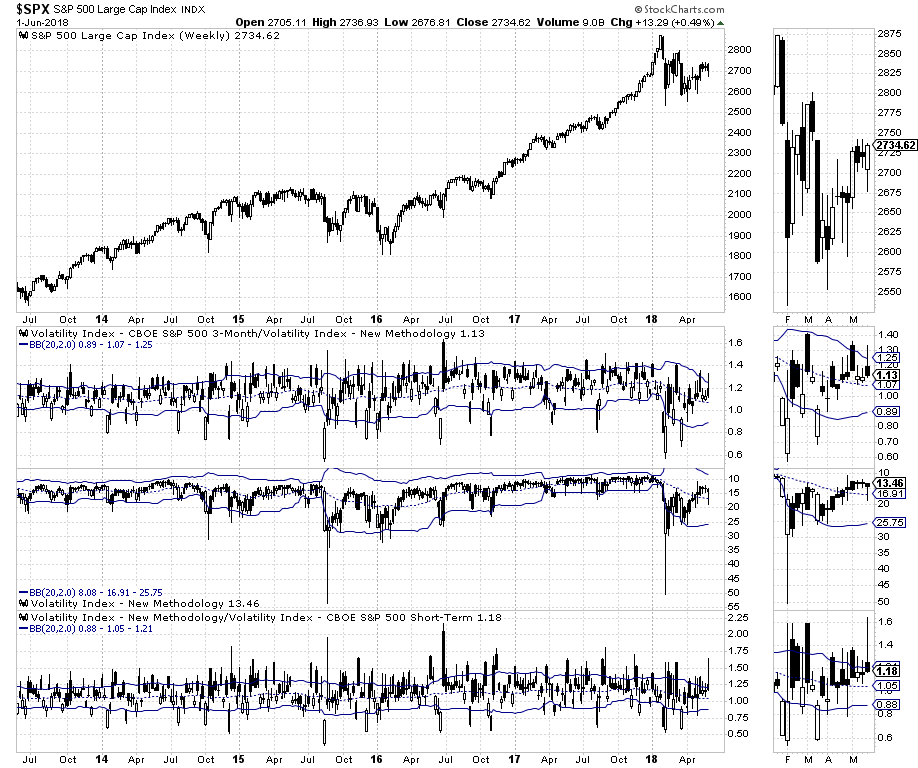

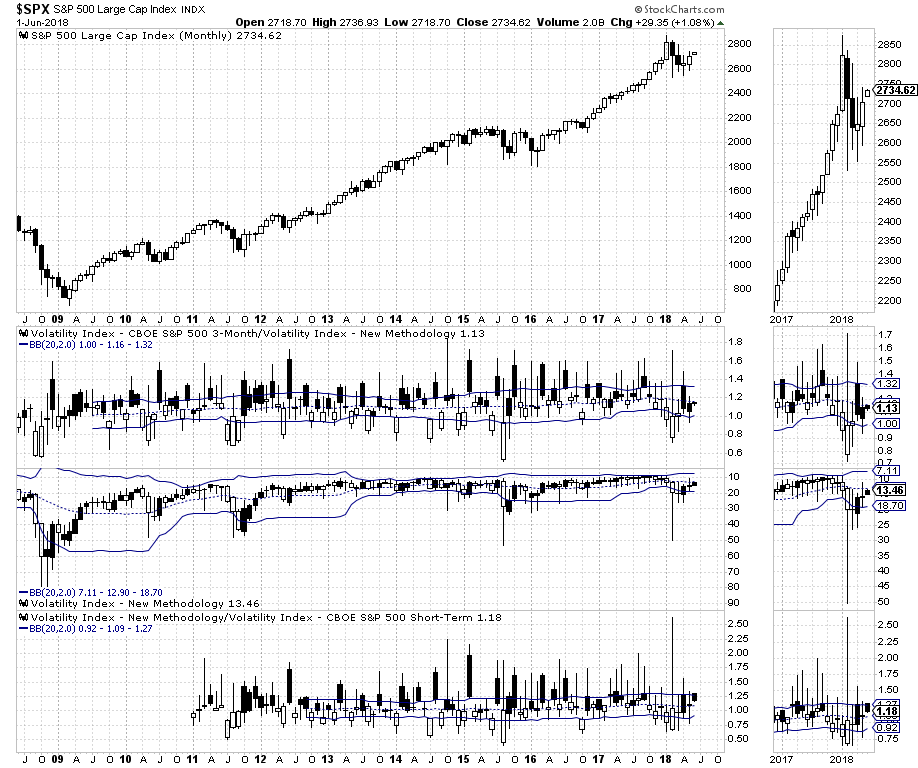

Helping to the fact that the expiration for this week is moderately pointing higher are the inverted volatility charts, weekly and monthly are certainly supportive of more upside; volatility is not excessively bullish but supportive.

Second: Cycles are close to be overbought with probabilities for a high tomorrow Monday June 4th; I think we have a combination of factors that could give us a high tomorrow, the deterioration could start tomorrow after mid of the session or on Tuesday. Please pay attention to supports before assuming correction is starting.

EW Analysis:

We have advised you for the past five or six weeks to be long $QQQ,but now the medium term chart could point to a top at the 1.382 extension at 175.50

and the subdivisions should point lower to 173.84

with a conservative average at 174.45, aggressive traders could do well by looking for 176.83. Important supports at 170.

For $SPX,

our approach has not changed micro subdivisions point to 2751/2755. The micro subdivisions we are using as alternative 2, perfectly allow the 2751/2755 range with extensions to the upside probable. For your safety we are not going recommend to short the market aggressively excepting SPX breaks under 2713 with follow through under 2702.

Weekly and Monthly Charts are still showing some strength..

Most $QQQ names in our portfolios have room to go higher, between 3 and 6% before major targets met.

Sometimes market is clear, sometimes market is not, sometimes you catch all the ride, sometimes you are late to the party… remain calm and focused, stay disciplined and do your own homework. Have we all a nice trading week

Again we will give more detailed trade setups and targets, please check us our Chat Room..as low as 15 dollars.. check this link for options

Access to the Trade of the Week Click Here

Seeking Options Team – RQLAB

SeekingOptions.com its partners and/or 3rd party affiliates are in open entry/closing positions in all of the above stocks, options, or other forms of equities. The trades provided in the above daily/weekly watchlist are simulations based on SeekingOptions oscillators strictly for educational purposes only, and not to solicit any stock , option or other form of equity. Under Section 202(a)(11)(A)-(E) of the Advisers Act this information is not considered investment or portfolio advisement from an authorized broker registered by the S.EC. (Securities Exchange Committee) and is limited to the scope of education in the form of market commentary through simulated trades via SeekingOptions.com indicators, and other educational tools.

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Use of any of this information is entirely at your own risk, for which SeekingOptions.com will not be liable. Neither we nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness or suitability of the information and content found or offered in the material for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude liability for any such inaccuracies or errors to the fullest extent permitted by law. All information exists for nothing other than entertainment and general educational purposes. We are not registered trading advisors. SeekingOptions.com is not a registered investment Advisor or Broker/Dealer. TRADE AT YOUR OWN RISK

Page 5 of 12« First«...34567...10...»Last »