Market Updates for August 9, 2016 – $ES_F, $SPY, $CL_F

The S&P 500 ($ES_F) futures trade off overnight highs, floating two points above fair value. The $ES_F long posted at close yesterday reached both the 1.27% and 1.618% targets overnight.

$ES_F and all indices are in same relative position.

Weekly Trend Bear: A multi-week high should be complete this week.

Daily Trend Bull: The net trend should be sideways to up over the next few trading days.

The Daily chart posted Saturday in the Chat Room has support, resistance and timing leveles.

Daily 8ma looking back OSC fast line is in Overbought zone while 13ma looking back is still bullish, a need for the 8ma to have a BearRev and at least 13ma looking back fast line to be Over bought before Daily and weekly trends should turn Bear

Intra Day – 240 Bull- 60 OB – VV AD Pre mkt = 1.55 – Razz Sync = Up ..looking for 60m BullRev to align with 240m Bull – so today’s net orientation sideways to up

15 Minute Chat

The above 15 minute $ES_F pre-market chart count are just short term.

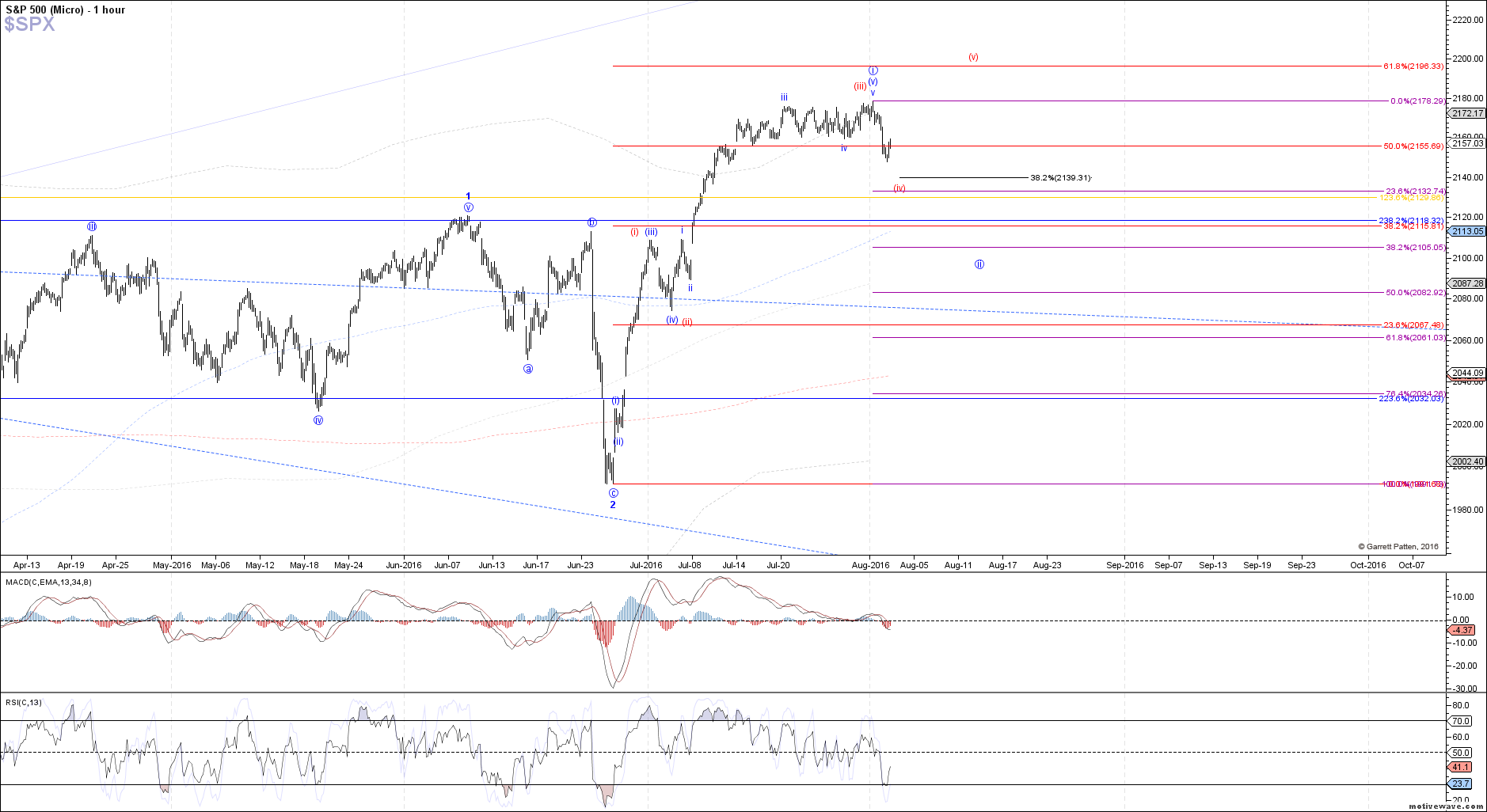

60 Minute $ES_F Chart

The 60 minute chart again demonstrate the power of Fibs.

Regarding Crude Oil, to consider any downside scenario, we have to see if the 44.10 resistance would be taken our or not. If we go back below 41.7 support area, we should think that the high is in and we will have another short opportunity.

Chat Room – Seeking Options

The Best Trading Chat Room. Learn to trade Stocks, Options, Futures, FOREX – True Financial Social Network Community

We will continue posting updates in our Chat Room

Happy Trading