by Carlos Narváez | Aug 2, 2017 | RQLAB

Previously:

- June 29th: AAPL: went under 4.236 extension for a moment, but closed above it (link).

- June 28th: AAPL: Still holding the previous 4.236 extension, would not be aggressive on the short side while this line holds. Experience tell us not to do it.

- June 25th: AAPL, looks more like an ABC retrace on the path to 161 (link)

Current Update:

$AAPL held the line at the 4.236 extension and now at a minimum should hit 162.95 with potentials to extend to 172.9 (link). Support for higher subdivisions toward the 170 and 190 needs to hold 156.17, this is extremely clear on this medium term chart (link).

Micro should hold 155.77 and 153.22 (link); under any scenario a break under 153.22 is constructive.

Post Earning Idea:

There’s only about a 17% probability AAPL will touch $192 by the end of the year. And if you think AAPL will have trouble maintaining its current price and are bearish on it, the long put vertical that’s short the 157.5 put and long the 162.5 put in the Sep weekly expiration with 37 DTE is a bearish strategy that, depending on where AAPL opens up today, has about a 60% prob of profit at expiration.

by Carlos Narváez | Jun 28, 2017 | RQLAB

Open Interest: for this Friday 6/30/17, PCR is at 3.774 (DN from 3.804) and for next week PCR is at 2.830, these PCRs are stable and with no inversions we must assume the shape of the short and long term razz should play out. Both are looking lower: into July 22nd short term and August expiration, long term.

Moores’ 2C-P is quite high, currently at 98.7, this needs a reset at least to 70 to support a solid advance in the markets.

MOC, around $1 billion sell side yesterday. Adding more elements to the downside pressure.

EW:

Market closed under the 2425 level. Further weakness under 2395 during the next days will invalidate any potential bullish inclination we still could have. I am not surprised, 2458 was a hard area to take, as we mentioned, and from June 4th- June 8th, we recommended stops for shorts at 2460 and SPX was trading at 2440 so I am not impressed with the chest thumps of the bears. Hope they get their pullback.

Once the SPX breaks 2395 we will put our initial level to watch at 2303 with next level that must hold at 2233.4.

Now that most of the QQQ stocks have broken support we will update some potential targets, I will update in the order they break support areas, won’t generalize:

Blue lines are 1% extensions:

FB: slightly below .618, but not much, so won’t update yet.

NVDA: under 142.11 ABC updated target projects to 135.49 (link), close to previous 3.618 support, re-upside at a minimum should be 155.

AAPL: Still holding the previous 4.236 extension, would not be aggressive on the short side while this line holds. Experience tell us not to do it.

AMD: Nothing broken yet

NFLX: under 147.30 ABC updated target projects to 141.10 with potential for 127.23. NFLX is the most compromised of the stocks until now, can make a case for 5 down (link) that could trigger a 3rd wave down and 3rds on NFLX goes to 2.618 that puts 111.23 in the cards.

AZMN, nothing broken yet.

TSLA, not sure what TSLA is doing, it is an anomaly that has not tried for the 1.764 at 400, updated support is 351.

TNA, still has not broken under 54.25, this still might be a deep wave 2

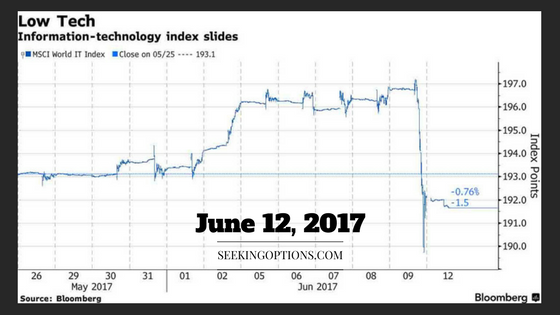

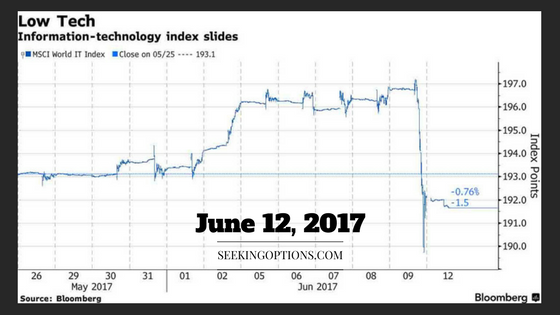

by Carlos Narváez | Jun 12, 2017 | RQLAB

Before posting our regular analysis allow me to remind you why we go long when most stay in the sidelines and why we take advantage of our analysis to add strong stocks:

Our analysis is highly valuable, we measure the tape pretty well and we can project future price action in an excellent manner, but at the very core of our business we must keep speculation and investment separate and remember that if there is a secure way to be poor in the future is by not buying the breaking-through companies that are improving the life on Earth today in a constant solid and profitable way, specially during this bull market.

So instead of waiting for the last drop of our bearish call to fall we accumulate what facts show is quality, knowing that quality, more often than not comes back. More than our smartness this approach, accompanied with good risk management, is what has provided us the cash flow to stay in the game despite some concentrated losses.

We are not bullish here, do not read the above paragraphs as a call to be bullish or rational, but a call to look at facts and do not allow the sentiment to play an excessive role in our trading.

Analysis

Open Interests points Lower into July Expiration, this is July 22nd.

EW Analysis

QQQ, immediate support in the route to 153.67 is at 135.89 in a 3 months chart (link).

On the daily (link) if QQQ is playing in a series of i-ii-1-2 within the wave 3 of off the lows support for QQQ is at 137.60 and 1% extension is at 130.92. Always in the i-ii, support is at 135.69 (link) same as on the three months chart and on another wave count, so this 135 area needs to crack down to confirm markets are approaching to a decent correction.

Maintaining above 136.59 and 135.89 would be more an indication of consolidation rather than of an impending sell off, so again, this 136.59-135.89 needs to break to confirm bearish calls are playing out.

TNA/SPX, as posted on Friday

We have posted our upper supports for the market, should SPX break under 2395.9 we could say that bulls are not pricing the risk in a reasonable way. For TNA upper support after/if 57.90 is achieved should come at 54.02 with clear invalidation of upper bullish projections once it breaks under 52.35. Handle shorts with care and do not get overexcited if bears get some control.

TNA achieved 57.90 on Friday and something more (link), so there is no change on this 54.02 support, we can draw a breakout line at 54.69, and we should do well assigning different bullish alternatives with 60- 61 (link) as targets while this new line holds, obviously under 54.02 upside probabilities are off the table.

For SPX, no change, supports at 2429 with signal of weakness under 2395.9.

$ES_F hit W.5 of 5 of 5 tgts Friday…in multiple fib resistance zones…weekly momos are OB with Daily ..13 osc bearish. Also, traded right into 5-7 trading day timing zone. HOWEVER, this being said ES still needs a Daily close below w.4 …2421.75 to confirm a Daily and possibly weekly high is Complete.

For Market Updates and Real time Analysis, join our Chat Forum .

by Carlos Narváez | Apr 19, 2017 | RQLAB

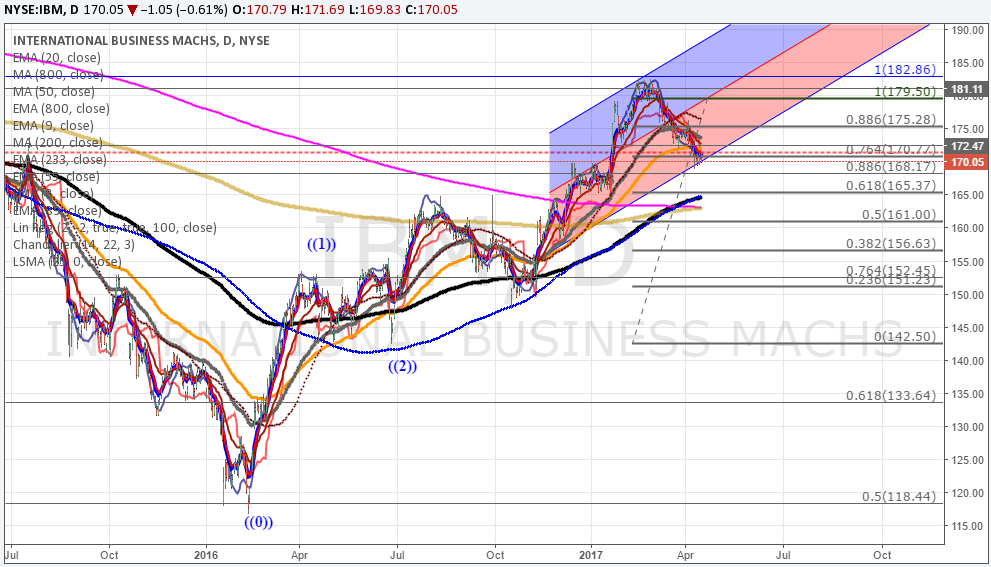

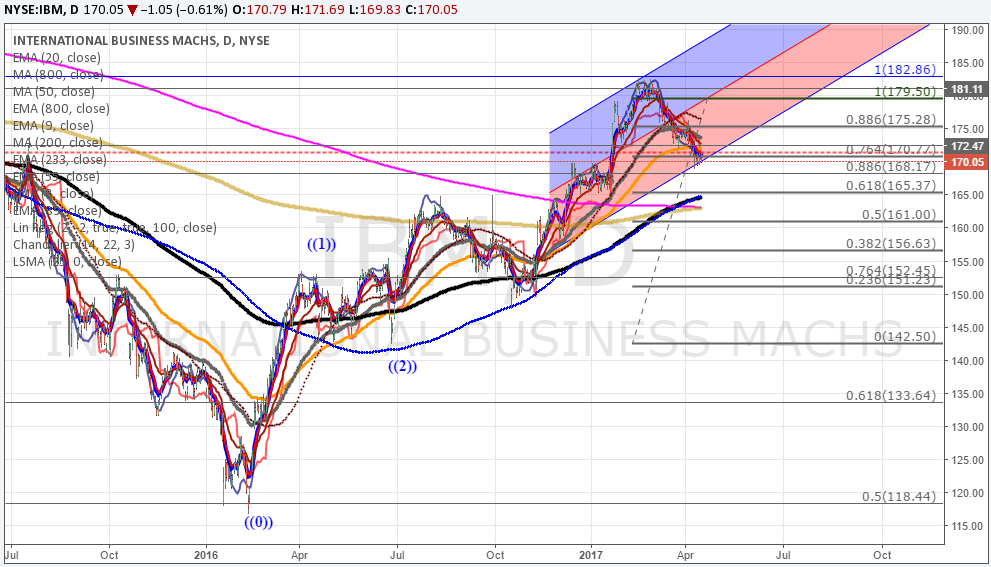

IBM

Looking at charts and we see an average of daily a good entry at 156.15 based on our trader system (Joel), that should be the confluence of the supports we see on the daily chart, Level 3 is at 158, so a spike down into this area should be “buyable”. Not sure about a bottom down there, but we could trade the retrace up.

We were expecting a bottom at 165, where others indicators aligned, daily 200 Daily Moving Average is right around daily Level 1 Level 2 support at 166; 164.747 monthly pivot just below them, 164.057 weekly pivot below that. -362 daily at 165.22. Additionally we had bullish .618 at 165 and now it is at .50 retrace at 161 as shown in Chart Below

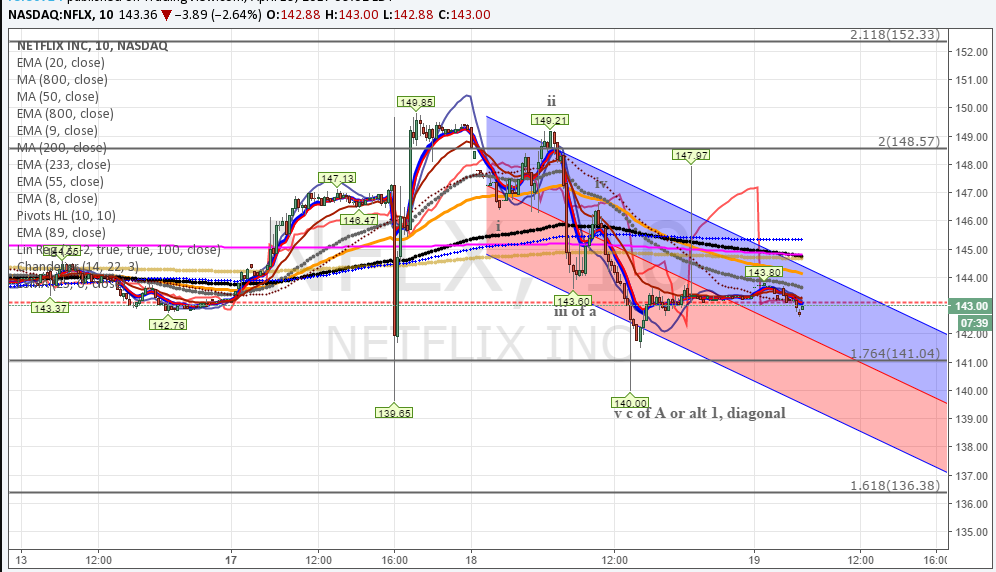

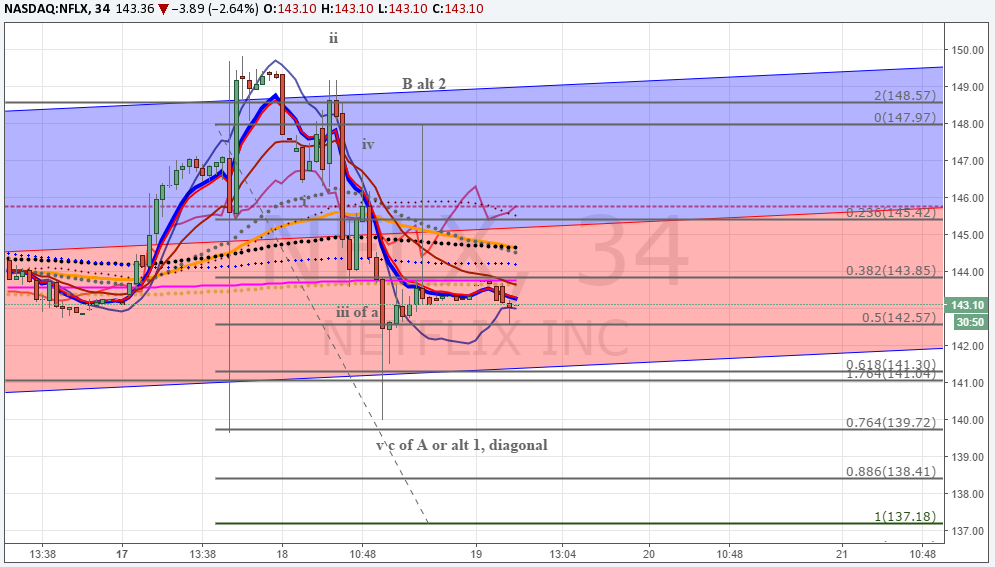

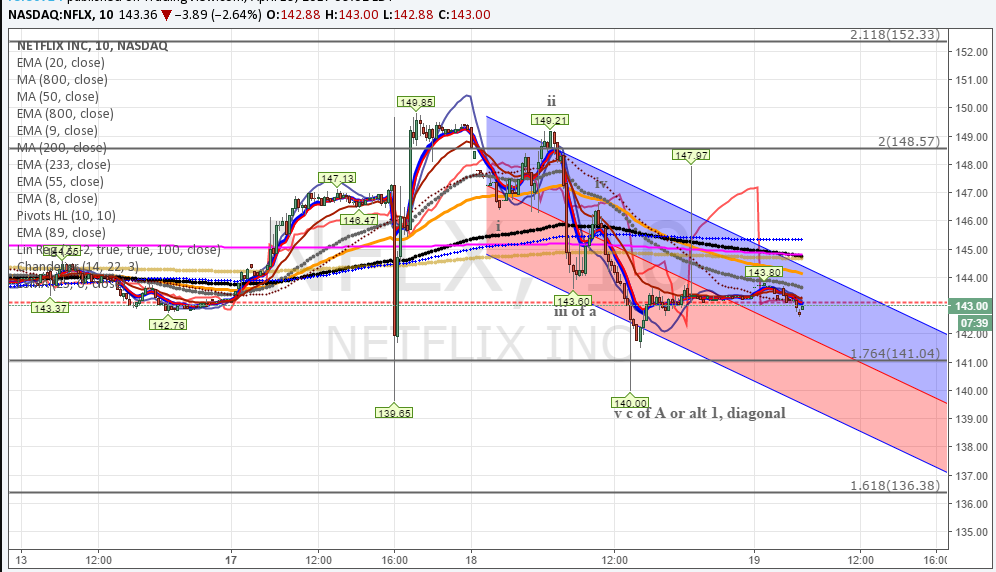

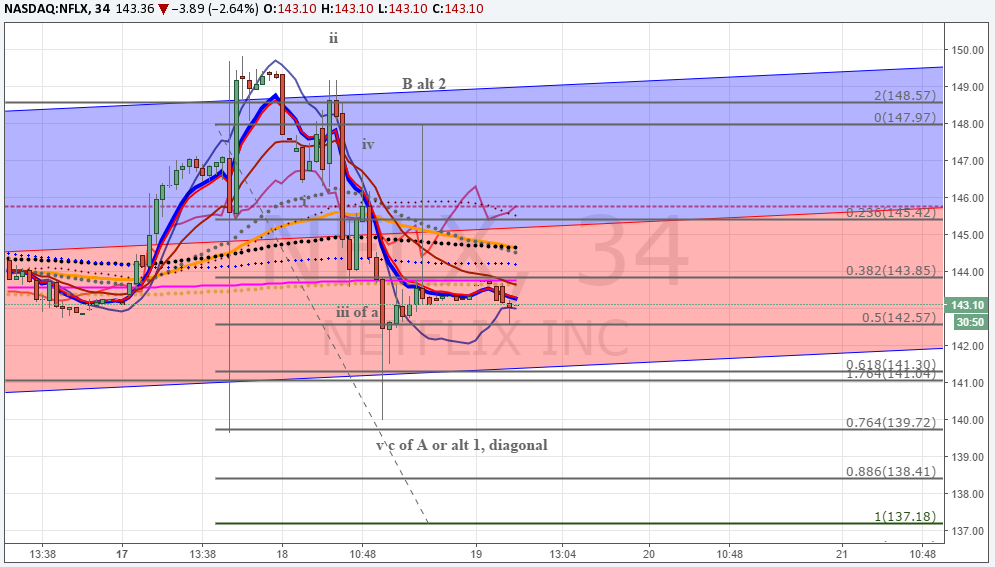

NFLX

Not too bearish yet, just the usual conundrum; very ABC chart style

Please notice how IRBs bottom at 140 area, meaning institutions are not letting it go, but if these levels fail potentially will bottom at 137.18 and 130, no reason to hold all the position in that case. Other important factor is the bearish IRB at .764 retrace at 147.97 could have completed any potential retrace, first indication that it will break down comes once NFLX breaks under 141.30.

Carlos

You want to trade with us? Try our VIP Room Special

by Carlos Narváez | Apr 6, 2017 | RQLAB

We are not surprised for this downside or that it developed in the shape of an intraday reversal. our expectations for the market to correct this week have been right, but in this particular case I failed to exercise due diligence on TNA. So I went greedy yesterday ignoring that I was forcing our longs at the top of wave 2 (link) so while we correctly called for TNA to top around 105.19 —where Joel sold— and 105.58 with upper resistance at 105.84 —level I wanted to sell— we did not dig enough into the pattern to recognize the potential danger. This was a clear mistake on my side. The fact that we sold other ETFs and stocks only contributes to confirm I should have looked deeper into our main trading instrument. I like coming after my mistakes it’s the only way I can prevent them in the future.

Open Interest continue telling us nothing spectacular on the upside is going to happen at the moment PCR: for EOW1 expiration on Fri 4/7/17 is at 4.746 (UP from 4.636). Change PCR was executed at 6.148 high, but not extremely high. For EOW2 Fri 4/14/17 expiration PCR is at 4.465 (DN from 4.921), still inverted and with the ratios inverted it is our expectation that market consolidate at the lows here for a while and the uptrend resumes into next week, per the shape of the short term razz.

So while we sent a bearish update on April 2nd and any short trade would be profitable at this moment traders should exercise cautiousness now that the discernible part of the retrace has developed.

Targets for TNA for as long as it holds under 98.93 is 94.45 then we should expect an upside retrace to 98.93 for a final low to 92 area, chart here (link) consolidation above/around 98.93 is positive to confirm a sort of bottom of a corrective pattern that would point to 111.30 as target for TNA.

Finally let’s not forget our 82 target where underwater shorts should be sold, market seems to be working in series of 1-2-i-ii meaning that target is reasonably probable if weakness continue to show up, but we avoid getting too bearish, reversals to the upside tend to be wild since bottoms are events.

Carlos

You want to trade with us? Try our VIP Room Special