by Carlos Narváez | Dec 12, 2016 | RQLAB

A neutral case for the market:

—01

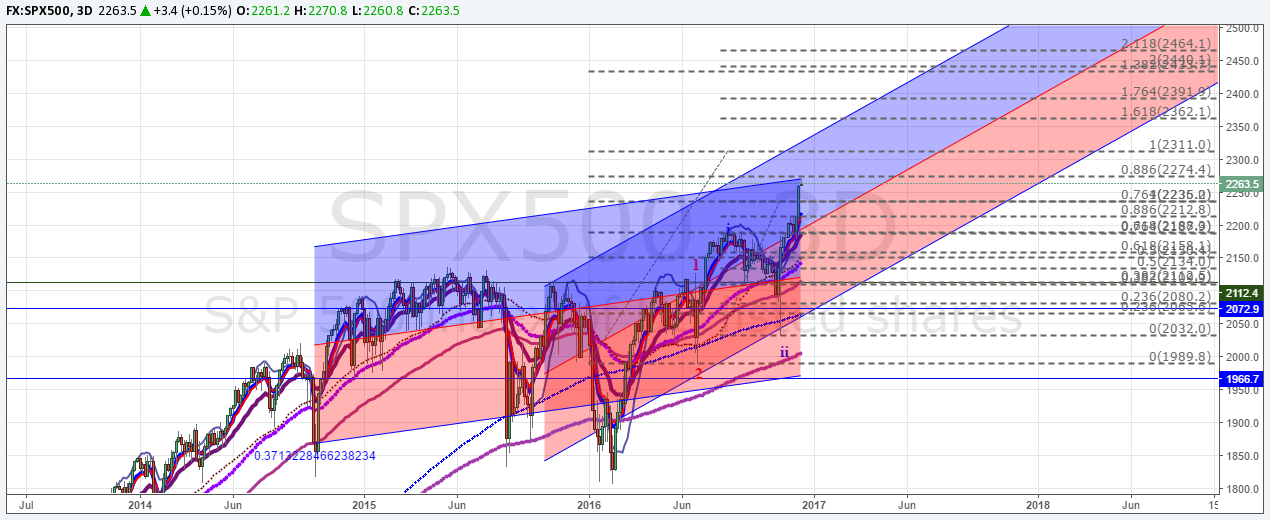

SPX

I would be extremely concerned if SPX goes above 2274, as seen here (link), any advance above this level with further progress above 2311 gonna put bears in serious danger, since from that very moment (once above 2311) 2274 is going to act as support on all pullbacks, a breakout above the range is a serious breakout and we should expect 2390-2500 to be hit sooner rather than later. Double support for SPX is 2136.

Xel’naga’s sentiment reading is at 93, that bodes well for a pullback too; last time this signal triggered yielded a five percent pullback, but topping process takes time. RVX, has not even broken first line of support on this chart here (link), that’s something we denoted on our previous updates, we do not expect RVX breaks under 14.20 despite the strength of this rally.

—02

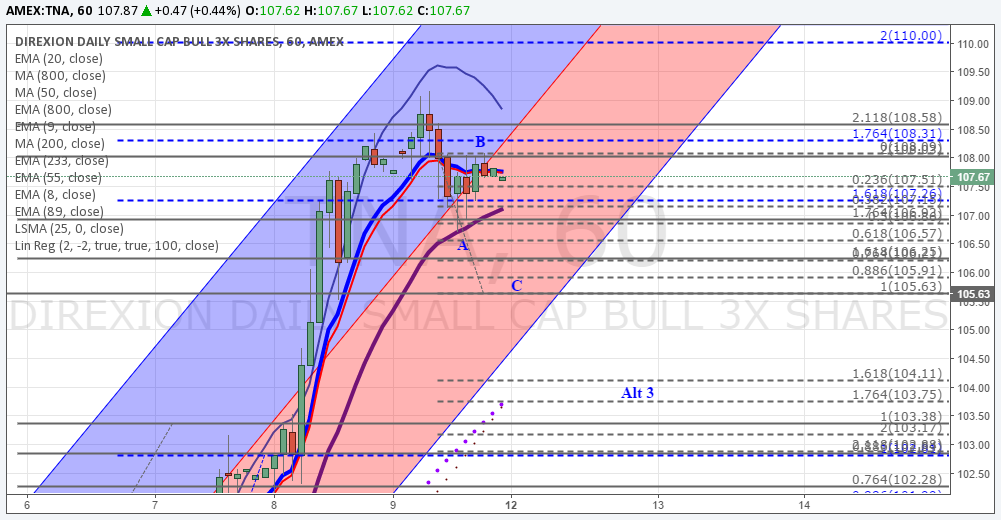

TNA on Friday left a nice setup for a pullback to 105.63 and potentially, if bears have some luck into 103.53, fibonaccis here (link). We would like to point out though, that even we have a projection for 103.53 this is not a recommendation to short but to watch for buying opportunities with proper stops. Additionally a test of 101.10 area with strong reversal above 103.53 it is a serious signal that market is ready to extend to new highs. We should not short TNA with conviction here and we should pay serious attention to what the price does at 101, if that level is seen.

—03

We should not allow FED meeting this week to cloud our minds, this is a non event.

Supports for the big banks

- JPM: 79.33

- BAC: 21.45

- C: 59.49

- AIG: 64.51

- GS: 230.09

- USB: 47.97 (beautiful chart, link)

- MS: 37.57 (the leader)

- PRU: 89.77 (perfect fibonacci pinball, link)

- ZION: 38.89

by Carlos Narváez | Dec 9, 2016 | RQLAB

TNA

From 91.76 support TNA managed to climb 19% to yesterday’s highs at 108. We have had 108-114 as targets areas for about one month in our books and we have been trading the long side based on the micro patterns.

The question we ask now is, should we be chasing the last squiggle to 113.46 or 5% more in the upside? The answer depends, ideally we should get a pullback to 102.88-103.38 as seen here (

link), in case we have this micro pullback, stop for any trade entered at 103 area should be 100.30 with potential target at 110.45-113.45 and this is a decent risk reward. In any other case we are reluctant to chase a 5% move to the upside, simply because if market starts to correct, standard retraces for support are 87.35-80.42 and this move has been so fast that from here to 98.76 there is only air to support a correction.

For any trade chasing 113.46-114, hard stop should be 106.25

Citigroup

If we had to chase something, that would be our lagger in the XLF sector, Citigroup, with a tight stop under 57.92 and target at 66.37. Long term Fibonacci here (

link) and red Fibonacci with .886 retrace support at 57.92, here (

link).

by Carlos Narváez | Dec 8, 2016 | RQLAB

Market Updates for $TNA, $C, $XLI and $NUGT

TNA

Yesterday’s update remains fully applicable:

Now what? Well, this is a point where we must work on recognizing the probabilities for the market to take out our wall at 101.42 and advance above it consistently, not only in a spike up, but in a trend mode for 105-108 and finally 113.46.

For now immediate average support for the market is at 94.93,

with more detailed fibonaccis here (link2), by opening link 2, things are very clear, should the market take today’s highs, this is 101.30, immediate target is 103.03, with clear level to watch at 101.42, once/if market hits 103.03, previous resistance at 101.42, 100.31 and 100.21 will become support, Ideally, it must hold 101.21, and by doing that we can increase target to 108 once 103 is retaken. Think the path is more clear now and less risky.

As an additional note: Volatility is being stretched too much, 16.14 is next support line on RVX and we seriously doubt that 14.06 line is going to be taken consistently, chart here (link). Reason we are very cautious here.

For tomorrow Thursday, ideal support for TNA is 101.6 or gray .618, chart here (link), under 101.6, support is 101.10. For trades, those levels can be bought with stops at 98.72, above 103.38 target for TNA is 106.25. Today we started longs at 100.80 and 101.90, we got 103, but we decided to hold with GTC stops.

NUGT

We must be ready to buy NUGT above 8.83, if we notice strength in the price, we should not overthink, target 9.75-9.97. Stop 8.08

Citigroup

Very close to targets posted on November 14th. Citigroup: target 60.02-61.96 (Right now best R/R is on this old lagger)

XLI

No change from November 14th

We consider 62.94 on XLI is reasonable probable, chart here (

link) and once/if this level is taken we can elaborate secure targets for 65.50 and 66.99.

Want new articles before they get published?

Subscribe to our Awesome Newsletter.

by Carlos Narváez | Dec 7, 2016 | RQLAB

Market really tries to make things easier but sometimes we decide to ignore what price is telling us. First traders needed to wait for 99 to be taken on TNA to chase a breakout, but that level was lowered by the price to 96.50. So no longs should be trapped here on TNA.

On

RQLAB Channel we detected intraday resistance for the market at 100.21 and if you reviewed our yesterday’s update you would probably have noticed that the 4.618 extension was 100.31, chart here (

link). So far, that was the high for TNA today; 100.31. We sold our TNA longs at 99.80, and we will wait for more information to trade the long or the short side.

Now what? Well, this is a point where we must work on recognizing the probabilities for the market to take out our wall at 101.42 and advance above it consistently, not only in a spike up, but in a trend mode for 105-108 and finally 113.46.

For now immediate average support for the market is at 94.93, chart here (

link1) with more detailed fibonaccis here (

link2), by opening link 2, things are very clear, should the market take today’s highs, this is 101.30, immediate target is 103.03, with clear level to watch at 101.42, once/if market hits 103.03, previous resistance at 101.42, 100.31 and 100.21 will become support, Ideally, it must hold 101.21, and by doing that we can increase target to 108 once 103 is retaken. Think the path is more clear now and less risky.

As an additional note: Volatility is being stretched too much, 16.14 is next support line on RVX and we seriously doubt that 14.06 line is going to be taken consistently, chart here (link). Reason we are very cautious here.

NFLX

Upper support for NFLX is 123.69, next average support is at 121.78 followed by standard support at 119.95. Above those levels, new target for 129.10 should be consistent.

by Carlos Narváez | Dec 6, 2016 | Market Update, RQLAB

After hours high for $TNA was 97.33, on this clean chart here (link) and (link), you can observe the hit at the 4.236 extension that we have been tracking from the lows, and here want to extend, because for some time we have been very cautious with this market; we have considered that the 4.764 extension located at 101.42 is strong enough to stop this move and provide a decent pullback, but considering the microstructure, the blue 1 up, (link) and for as long as the market holds ─ideally but not necessarily─, above 93.95 is probable that the market breaks out above our resistance level with ideal target for this leg up at the 104.91-105.89 range.

Initial indication for a major extension to 104.91 and 105.89 is a move to 100.81 that only retests the supports at 97.76 and then breakout above 101.42, once the market does that, it is very reasonable that 104.91-105.89 is on track.

We were very cautious with the 91.76 support level for shorts; here there is no reason to be bullish or bearish but to allow the price to prove itself. Best entry for conservative traders would be on a pullback to 93.96, since we are are still concerned about 101.42; rarely that extension is taken, but time and parameters will indicate if we are wrong and the market will surprise to the upside and we must be prepared.

A break under 90.56, last low, would invalidate these scenarios and we would maintain our solid buying areas detailed previously.

$FCX:

Supports for FCX are at 15.52 and 15.37, it is a stock in which we have no opinion, but setup is too good to ignore, so we are long.