A neutral case for the market:

—01

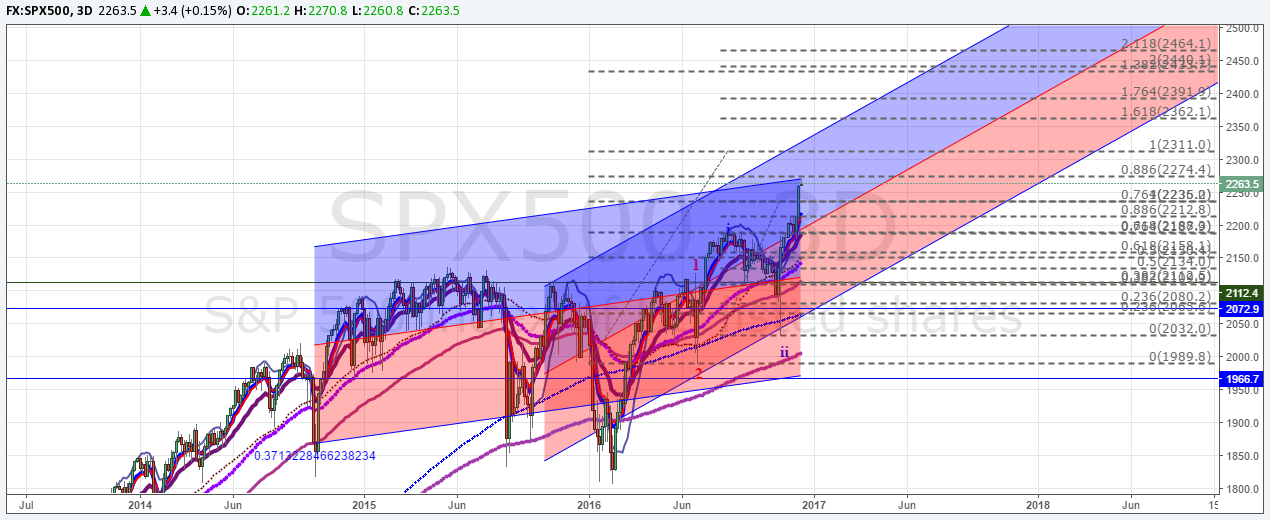

SPX

I would be extremely concerned if SPX goes above 2274, as seen here (link), any advance above this level with further progress above 2311 gonna put bears in serious danger, since from that very moment (once above 2311) 2274 is going to act as support on all pullbacks, a breakout above the range is a serious breakout and we should expect 2390-2500 to be hit sooner rather than later. Double support for SPX is 2136.

Xel’naga’s sentiment reading is at 93, that bodes well for a pullback too; last time this signal triggered yielded a five percent pullback, but topping process takes time. RVX, has not even broken first line of support on this chart here (link), that’s something we denoted on our previous updates, we do not expect RVX breaks under 14.20 despite the strength of this rally.

—02

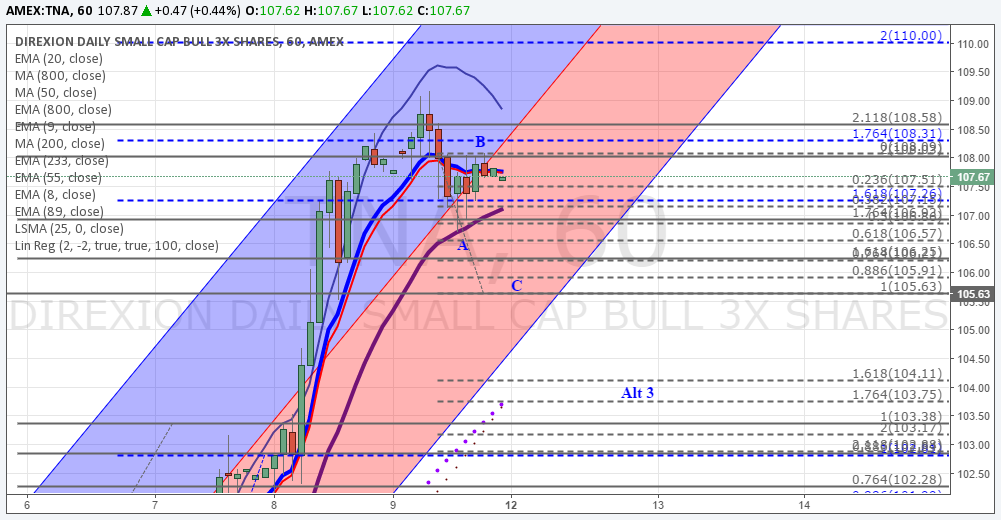

TNA on Friday left a nice setup for a pullback to 105.63 and potentially, if bears have some luck into 103.53, fibonaccis here (link). We would like to point out though, that even we have a projection for 103.53 this is not a recommendation to short but to watch for buying opportunities with proper stops. Additionally a test of 101.10 area with strong reversal above 103.53 it is a serious signal that market is ready to extend to new highs. We should not short TNA with conviction here and we should pay serious attention to what the price does at 101, if that level is seen.

—03

We should not allow FED meeting this week to cloud our minds, this is a non event.