by Alpha | Jun 5, 2018 | Portfolio, RQLAB, Stocks to Watch

This is a quick update to one of the Portfolios that we manage in RQLAB

We will go by listing some of our updates that we post regularly in RQ Trades Room

- We took gains on $IQ, hit target as expected, congrats! Total gains $1696.80

- We sold $AMZN on June 4th for a net profit of $ 2,581 and then repurchased it again taking it to possible target of 2730-2740

- We sold some $NVDA calls for $ 248 in net profits

- We took some gains on $ANET at 268.53 for 2,063 in net profits, however we still think it can head to 280

- We did a tactical retreat on $AAPL waiting for clarity on indexes so we sold our 210 shares at 191.97 for $1,035

- We sold $HTHT at 46.3 for $1,064 in net profits

- We Closed $YY calls for 71% or $ 1,600 in profits…

- Given we Sold $AAPL shares, which might make us the potential move, we added some exposure on AAPL by buying 3 $AAPL October 200 Strike Calls For 7.60

- We are Over weighted $AMD and finally got some exposure on $TSLA via Sep Calls

You Need help with your portfolio, please send us an email [email protected]

ACTIVE PORTFOLIO

MANAGEMENT

e – High Returns

ACTIVE & PASSIVE

INVESTING

SHARE ON

by Alpha | Jun 5, 2018 | Market Update, RQLAB

SPX/QQQ

A good start to June with some new money, but it was a Friday. Futures were higher from the open of trade with great Jobs report, holding a fairly tight range into the actual jobs report. The President tweeted a couple of hours ahead of the release that he was looking forward to the numbers, and that was interpreted as an indication they would be good. Leaving all that Fun aside, lets look at market mechanics.

OI and our EW indicator are indicating a significant divergence into next week, so it is our duty to monitor sentiment versus Open Interest in order to make correct decisions.

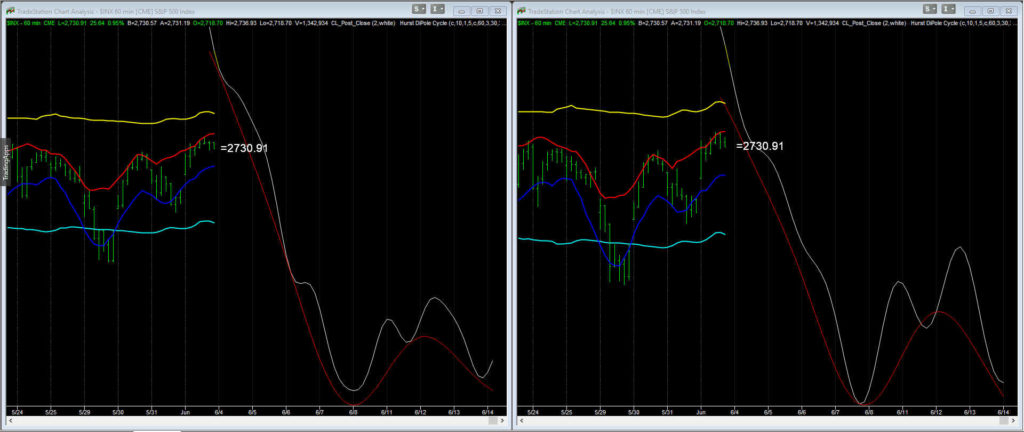

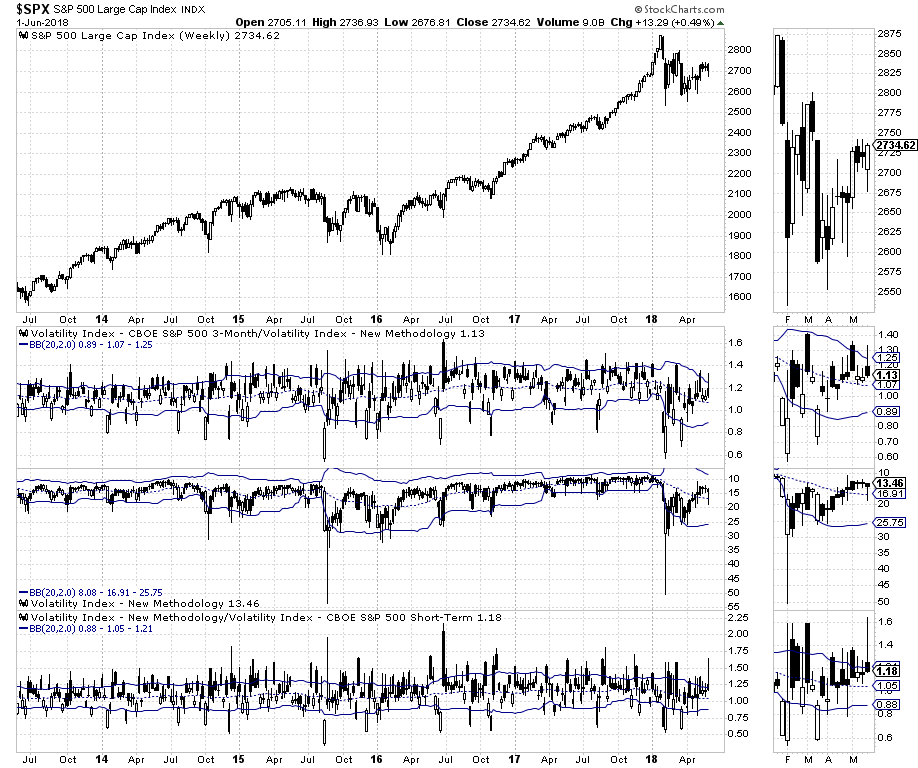

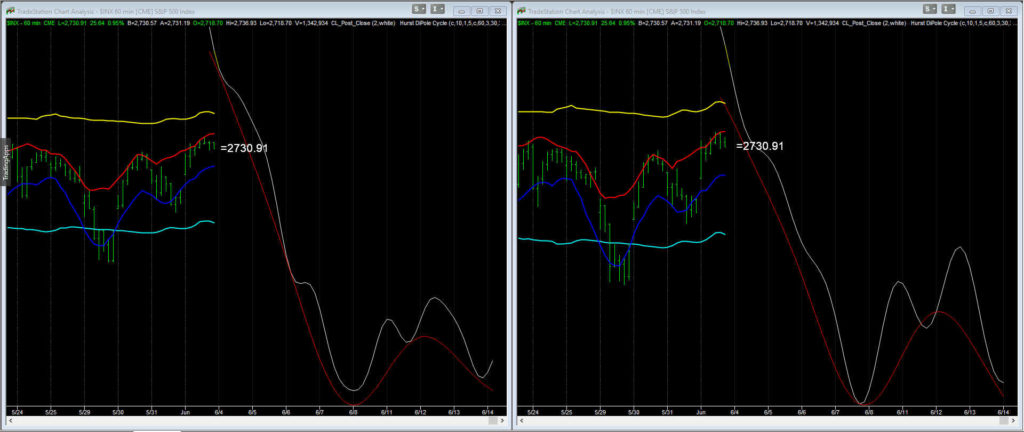

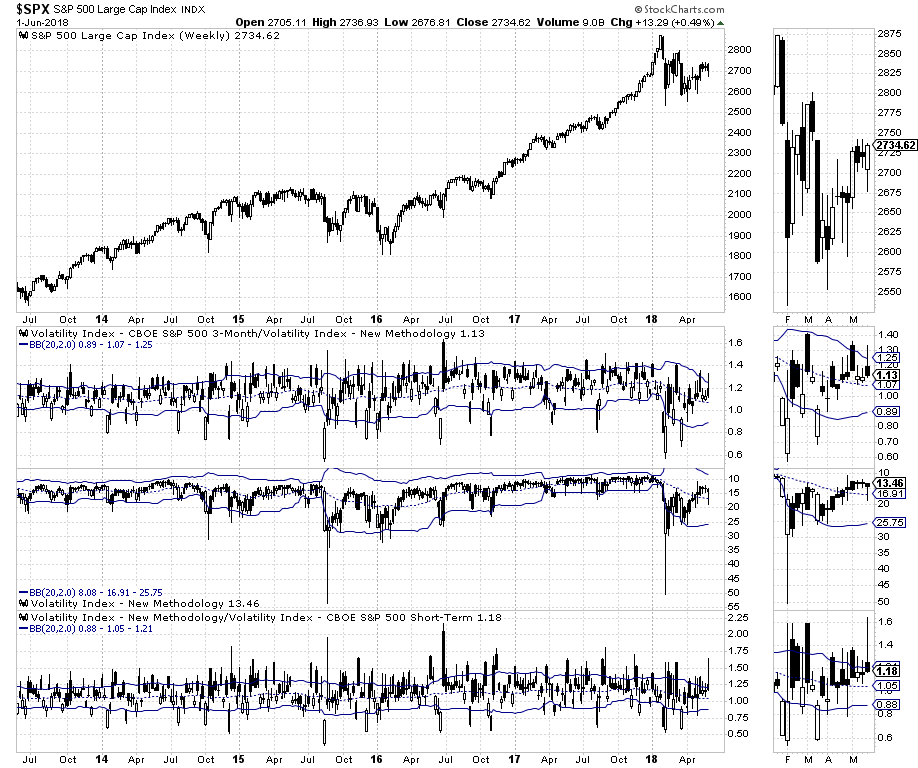

First: The spike we had been expecting, concluded last week as we can observe on the attached weekly chart elaborated by Joel Withun. This same weekly chart is now indicating downside at least until June 15th, Put Call Ration, is at 2.064 so projection is valid based on our experience. Opposing to this is the fact that expiration for this Week is positive when compared to EOW1, up in a moderate fashion.

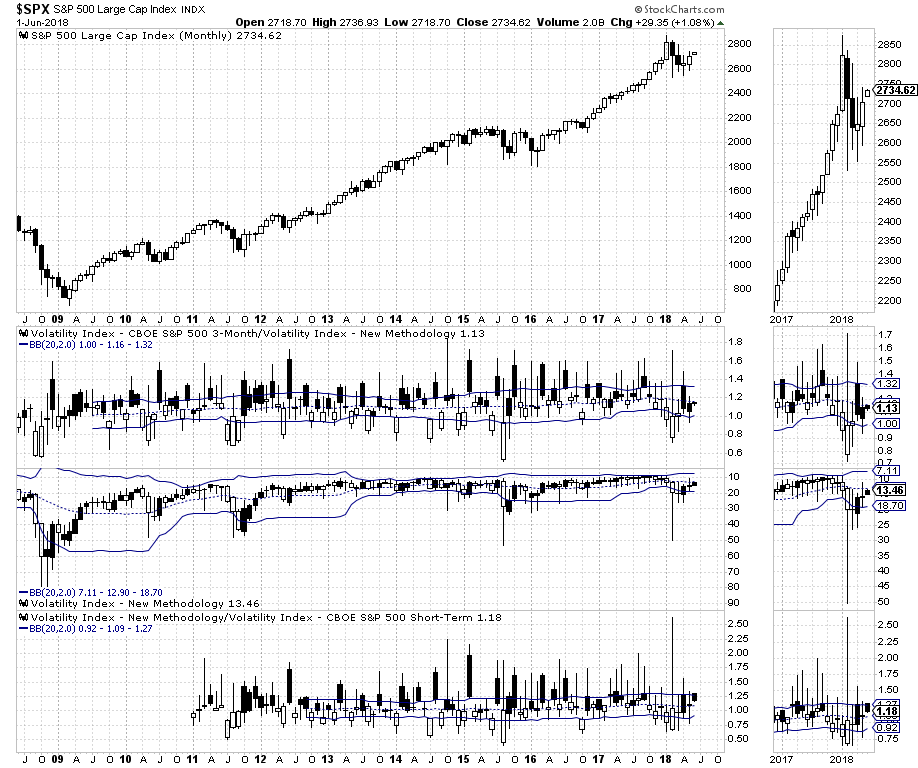

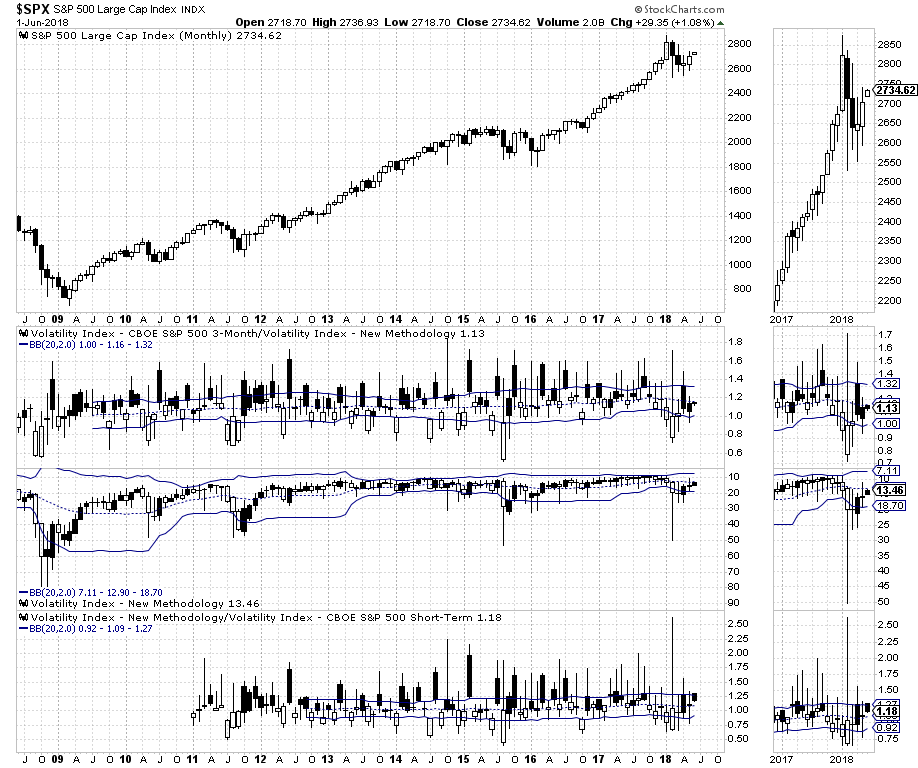

Helping to the fact that the expiration for this week is moderately pointing higher are the inverted volatility charts, weekly and monthly are certainly supportive of more upside; volatility is not excessively bullish but supportive.

Second: Cycles are close to be overbought with probabilities for a high tomorrow Monday June 4th; I think we have a combination of factors that could give us a high tomorrow, the deterioration could start tomorrow after mid of the session or on Tuesday. Please pay attention to supports before assuming correction is starting.

EW Analysis:

We have advised you for the past five or six weeks to be long $QQQ,but now the medium term chart could point to a top at the 1.382 extension at 175.50

and the subdivisions should point lower to 173.84

with a conservative average at 174.45, aggressive traders could do well by looking for 176.83. Important supports at 170.

For $SPX,

our approach has not changed micro subdivisions point to 2751/2755. The micro subdivisions we are using as alternative 2, perfectly allow the 2751/2755 range with extensions to the upside probable. For your safety we are not going recommend to short the market aggressively excepting SPX breaks under 2713 with follow through under 2702.

Weekly and Monthly Charts are still showing some strength..

Most $QQQ names in our portfolios have room to go higher, between 3 and 6% before major targets met.

Sometimes market is clear, sometimes market is not, sometimes you catch all the ride, sometimes you are late to the party… remain calm and focused, stay disciplined and do your own homework. Have we all a nice trading week

Again we will give more detailed trade setups and targets, please check us our Chat Room..as low as 15 dollars.. check this link for options

Access to the Trade of the Week Click Here

Seeking Options Team – RQLAB

SeekingOptions.com its partners and/or 3rd party affiliates are in open entry/closing positions in all of the above stocks, options, or other forms of equities. The trades provided in the above daily/weekly watchlist are simulations based on SeekingOptions oscillators strictly for educational purposes only, and not to solicit any stock , option or other form of equity. Under Section 202(a)(11)(A)-(E) of the Advisers Act this information is not considered investment or portfolio advisement from an authorized broker registered by the S.EC. (Securities Exchange Committee) and is limited to the scope of education in the form of market commentary through simulated trades via SeekingOptions.com indicators, and other educational tools.

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Use of any of this information is entirely at your own risk, for which SeekingOptions.com will not be liable. Neither we nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness or suitability of the information and content found or offered in the material for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude liability for any such inaccuracies or errors to the fullest extent permitted by law. All information exists for nothing other than entertainment and general educational purposes. We are not registered trading advisors. SeekingOptions.com is not a registered investment Advisor or Broker/Dealer. TRADE AT YOUR OWN RISK

by Alpha | May 29, 2018 | Market Update, RQLAB

SPX/QQQ

May is almost over and with this one of the strongest months for the $QQQ sector; June is certainly a month when technology companies under perform and not all holdings recover well during July, some companies like $MSFT or $CSCO tend to outperform or track pretty well the performance of $QQQ/$XLK for July, so those companies should be on your buy list if we see the expected weakness into June.

$AMD and $TSLA tend to do well during June, but we would put our money on $AMD rather than on $TSLA.

Part of the Seeking Options Strategies, we have long term trade system used to the comes and goes of the markets, so pullbacks like today, when market is down .80% at 2699 certainly don’t affect our perspectives, especially when we anticipated this retrace and we did advise you to buy long term calls and only to add solid companies to your portfolios. So again if you followed recommendations and you allocated capital on solid companies you should be doing well and by this time your collateral should be helping you.

We did recommend $SOXL components, like $MU, $INTC and $NVDA, and we still would expect $NVDA catches up and provide us the 270 conservative target we been talking about; with ideal target at 291.

Coming to $SPX —were we advised you to stay defensive— this morning we came back to the 2690 support on the micro

—we can see the red line— and on the medium term ABC

same support at 2690 area with ideal target at 2757 and if for a reason breaks above 2757 ideally will hit 2820.

The $QQQ, have serious pressure to the downside on many time frames, but two setups still point to 174/177, Medium term support for QQQ is 164.

Trade of the Week will be another winner this week with 54.55% profit bringing our portfolio profit to 57% YTD

Again we will give more detailed trade setups and targets, please check us our Chat Room..as low as 15 dollars.. check this link for options

Access to the Trade of the Week Click Here

Seeking Options Team – RQLAB

SeekingOptions.com its partners and/or 3rd party affiliates are in open entry/closing positions in all of the above stocks, options, or other forms of equities. The trades provided in the above daily/weekly watchlist are simulations based on SeekingOptions oscillators strictly for educational purposes only, and not to solicit any stock , option or other form of equity. Under Section 202(a)(11)(A)-(E) of the Advisers Act this information is not considered investment or portfolio advisement from an authorized broker registered by the S.EC. (Securities Exchange Committee) and is limited to the scope of education in the form of market commentary through simulated trades via SeekingOptions.com indicators, and other educational tools.

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Use of any of this information is entirely at your own risk, for which SeekingOptions.com will not be liable. Neither we nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness or suitability of the information and content found or offered in the material for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude liability for any such inaccuracies or errors to the fullest extent permitted by law. All information exists for nothing other than entertainment and general educational purposes. We are not registered trading advisors. SeekingOptions.com is not a registered investment Advisor or Broker/Dealer. TRADE AT YOUR OWN RISK

by Alpha | May 29, 2018 | Pre-Market

Quick market recap for May 29, 2018 ahead of the market open, we have tested 2690 on the $ES_F due to news from overseas from Italy, and possible downgrade to junk. After all this is not the worst for investors as this could mean ECB will not stop their Quantitative Easing (QE). In this week, traders will be keeping an eye on several upcoming economic events, including gross domestic product data on May 30, jobless claims on May 31 and employment data on June 1. The market will also be keeping a close eye on the evolving political situation in both Europe and the United States. Leaving all the FunDamentals Aside, lets get back to technical charts..

We spoke previously on the importance testing a low before resuming higher, and technically we did have that low this morning as we hit 2690. With that said the low has to hold before making a new high and possible target of 2770 and we can project to 2780 on $SPX. – as am writing this update market is trading over 2700.

CURRENT STRATEGY

As for the stock market, we still like the patterns in individual stocks and the stock indices are not bad either, having positions in $MU, $NVDA, $INTC, etc. They can only base laterally so long. Some did make moves on the back half of the week, including some chips, software, tech, drugs. $NFLX as well. We will see if those can continue upside this week as we let our other positions work. Therefore as long as 2700 area holds, we will be looking to add our Bullish plays on $SPY or $SPX via short term calls June or even July, once we break above 2740 with a stop at 2720.

Trade of the Week will be another winner this week with 54.55% profit bringing our portfolio profit to 57% YTD

Please review the following Daily $ES_F chart for details that may impact our trading setup, this chart will be updated closely in the chat room

Again we will give more detailed trade setups and targets, please check us our Chat Room..as low as 15 dollars.. check this link for options

Access to the Trade of the Week Click Here

Seeking Options Team

SeekingOptions.com its partners and/or 3rd party affiliates are in open entry/closing positions in all of the above stocks, options, or other forms of equities. The trades provided in the above daily/weekly watchlist are simulations based on SeekingOptions oscillators strictly for educational purposes only, and not to solicit any stock , option or other form of equity. Under Section 202(a)(11)(A)-(E) of the Advisers Act this information is not considered investment or portfolio advisement from an authorized broker registered by the S.EC. (Securities Exchange Committee) and is limited to the scope of education in the form of market commentary through simulated trades via SeekingOptions.com indicators, and other educational tools.

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Use of any of this information is entirely at your own risk, for which SeekingOptions.com will not be liable. Neither we nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness or suitability of the information and content found or offered in the material for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude liability for any such inaccuracies or errors to the fullest extent permitted by law. All information exists for nothing other than entertainment and general educational purposes. We are not registered trading advisors. SeekingOptions.com is not a registered investment Advisor or Broker/Dealer. TRADE AT YOUR OWN RISK

by Alpha | May 22, 2018 | Market Update

Lots of side way actions, and this time Russell 2000 is the index that is leading..

We can see that the index broke out of the ‘wedge’ pattern and the last two moves are nearly exactly the same – we have been long $TNA and thats one of the good winners..

Now, if this index is to ‘retest’ the upper trend line on this chart it would equal about a 3%-3.5% move lower from here and if the bull market is to take off – I suspect it would be from this area (around the $157-$155 level on the chart). So I have this marked on my screens for major support.

The same price symmetry just triggered in the Transportation index:

Slow day today with not much price action awaiting the Fed minutes (FOMC) which are scheduled for tomorrow, we are in the camp a break above 2740 on $SPX will set us to 2,750-2,755 and then 2770, we are waiting and we will be adding to our long positions. On watch the IWM and Transports react to such a move – do they each fail to make higher highs when the S&P rallies to 2,755? That will be key for me and would signal a sharp drop ahead.

Stay small and dont over react, patience is important.. and we have been waiting on some major stocks that we are following like $NVDA, $AAPL, and of course $GLD and $FCX

Updated Chart from Chat Room

We will give more detailed trade setups and targets, please check us our Chat Room..

Trending News:

- Celgene to Present New and Updated Data across a Range of Blood Diseas (BUSINESSWIRE.COM)

- Oil shock: Here’s what $100 crude would do to the global economy (MARKETWATCH.COM)

- Tesaro jumps after unknown Twitter account sparks takeover rumor (THEFLY.COM)

- Banned From Amazon: The Shoppers Who Make Too Many Returns (WSJ.COM)

- ACLU: Police using Amazon’s facial recognition tool could pose a ‘grav (CNB.CX)

- Acceleron Announces Initiation of PULSAR Phase 2 Trial of Sotatercept (BUSINESSWIRE.COM)

- Market In 5 Minutes: WWE’s Big Deal, Netflix And The Obamas, Sony-EMI (BENZINGA.COM)

Seeking Options Team

Access to the Trade of the Week Click Here

SeekingOptions.com its partners and/or 3rd party affiliates are in open entry/closing positions in all of the above stocks, options, or other forms of equities. The trades provided in the above daily/weekly watchlist are simulations based on SeekingOptions oscillators strictly for educational purposes only, and not to solicit any stock , option or other form of equity. Under Section 202(a)(11)(A)-(E) of the Advisers Act this information is not considered investment or portfolio advisement from an authorized broker registered by the S.EC. (Securities Exchange Committee) and is limited to the scope of education in the form of market commentary through simulated trades via SeekingOptions.com indicators, and other educational tools.

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Use of any of this information is entirely at your own risk, for which SeekingOptions.com will not be liable. Neither we nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness or suitability of the information and content found or offered in the material for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude liability for any such inaccuracies or errors to the fullest extent permitted by law. All information exists for nothing other than entertainment and general educational purposes. We are not registered trading advisors. SeekingOptions.com is not a registered investment Advisor or Broker/Dealer. TRADE AT YOUR OWN RISK