IWM/SPX/NDX

Moores’s 2C-P: Last time we registered a reading of 63 on 2C-P was on 8/8/17; by that time $TNA was hitting 48.60 or 47% under current levels. We would have to return to 3/24/17 in order to find a lower reading of 61 at 49.55 on TNA. Both readings, 63 and 61 marked significative bottoms.

D/U registered a record of selling pressure: 18.45; despite this $IWM is respecting previous 1.764 retrace (link).

Open Interest: there is not much coming from open interest, PCR. for this week is at 3.417, stable with both, short term and long term razzes pointing down. For next week EOW3, PCR is stable too at 2.442.

There is not recovery in sight from open interest. All calls we can derive from OI should be bearish.

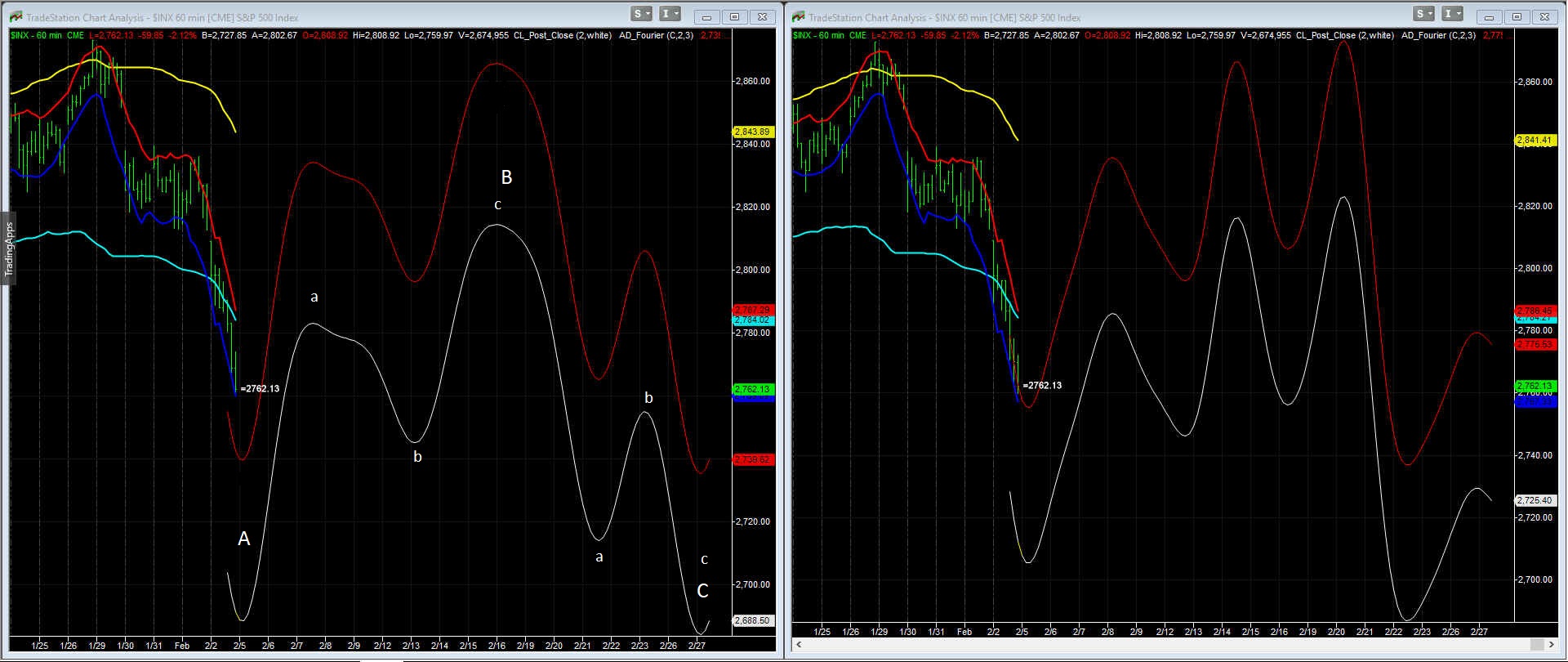

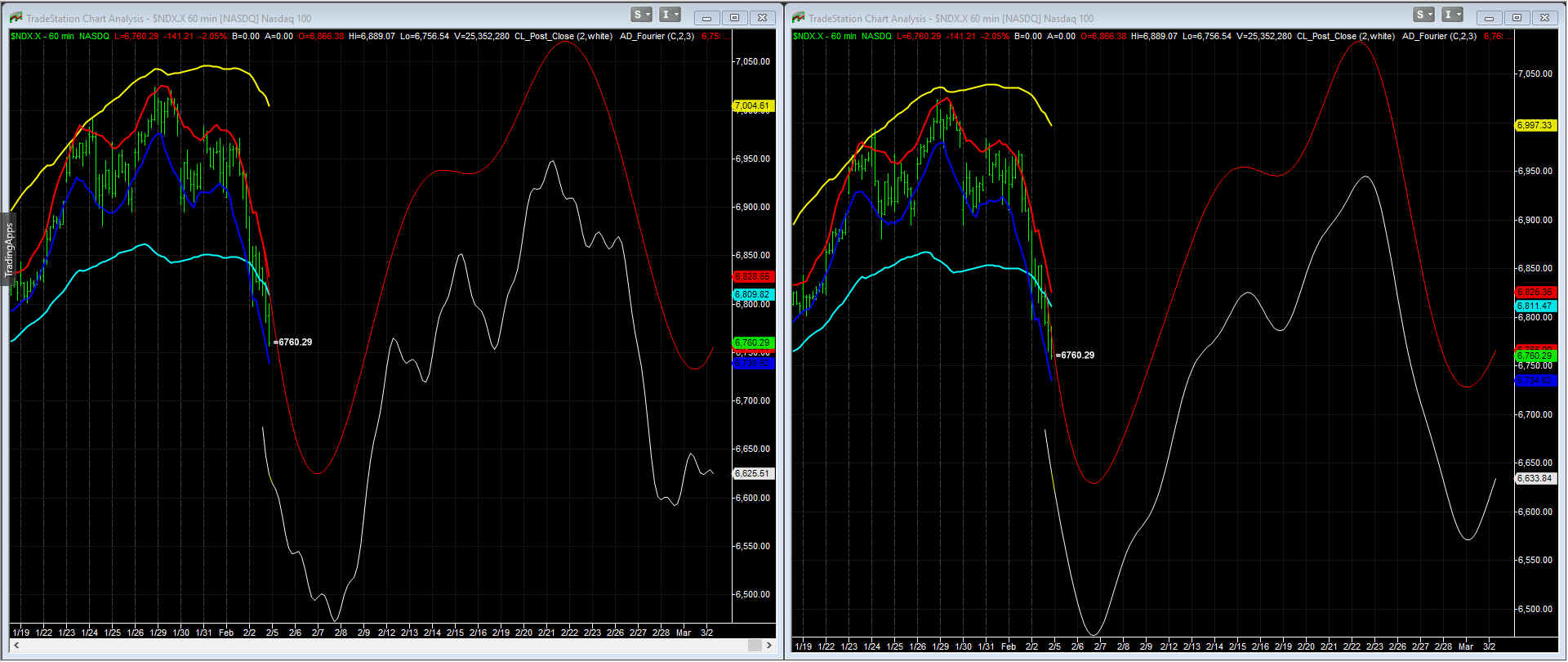

FNG’s cyclical analysis: Show both markets, NDX and SPX are cyclically oversold enough as to hope for more downside from right here. But recovery should not be immediate and straightforward, secure highs are projected between February 19th or the 21st for SPX.

Projected recovery for NDX looks better, with highs projected between February 21st and February 23rd, before a sort of c wave hits the markets again, according to this analysis.

I see 2C-P in alignment with cyclical analysis, and while a additional low is projected into late February, traders should do well considering this pullback as a buying opportunity, buying enough time to weather a lower low that might materialize or not. We have not had a setup like this in a very long time.

According to Leov Valencia: the long gamma/short gamma threshold right now is at: 2758.32 below that level SPX options dealers will be short gamma on the aggregate and therefore they will be hedging in the same direction that the market!. So this 2758.32 is the level SPX has to recover in order to alleviate downside pressure.

EW Analysis.

From January 10th

… Regrettably in such a big wave count, the smallest variation could affect the projections by a range of 30 points, so I rather to post for you these two lines: first support at 2719.2 (link) and second support at 2705.5 (link). In order to start feeling uneasy one of these lines would have to break, and sorry if some our past updates have leaded you to believe we are ubber bulls, we are not, simply we rather to view the big picture and wait for market to tell us if our bearish/bullish approaches are right, maintaining a considerable exposure on the long side until reality prove us wrong, and at this moment in time, a 20% pullback is, to our eyes unlikely, so stop auto-threatening you while at least 2705.5 is not broken, it is not necessary.

Current

We identified this retrace on January 26th, before it ensued —and while at that moment and at this moment we could project an additional 5.38% pullback to 2587, at a minimum, (link) or additional 9.64% with max targets at 2479 (link)— we since the very first moment considered market should find a consistent bottom around the Wolverine line, 2759. For that reason we are not factoring more downside as reasonable probable, instead of that we are considering bull markets should hold and consolidate around the 8 EMA weekly and then go for new highs, ideally to 3238 or 3271, at those levels we should be seriously worried.

In order to start at seeing things that we did not factor on January 26th, when market was hitting fresh all time highs at 2879, market should break the lines we considered on January 10th: 2719.2-2705.5.

Support for NDX should be 6693 or 6624 (link), there is nothing broken on NDX yet, but NFLX is not a safe haven any more and should not be a candidate to repurchase on pullbacks. GOOGL, AMZN, BABA, MSFT, TSLA should be better candidates.

It is easy to project more downside while pullbacks are occurring, as it is is easy to project more upside while uptrend holds, but we are not here for entertainment but to make money, and money according to the big picture is on the long side of this market.

Have a nice week.

Seeking Options Team [RQLAB]