Our history with IPOs

$TWLO

During 2017 I liked TWLO and I thought the wave iv could hold, based on the fundamentals behind it, $FB/WhatsApp related, so started buying the 50 area and well… eventually the price collapsed below the IPO price, but you will see, I considered $TWLO is a company where you want your kids to work at, so I decided to trade the 30 area, just to stop out for risk management purposes, —the I am too fearful to hold a position of this size here—.

At the moment of buying T$WLO I appealed to my ignorance and read into what $TWLO does… and by reading into that I asked myself what is an API? And then read $TWLO bought Kurento, and during 2017 TWLO bought Beepsend.

What’s Kurento?

Kurento is a WebRTC media server and a set of client APIs making simple the development of advanced video applications for WWW and smartphone platforms. Kurento Media Server features include group communications, transcoding, recording, mixing, broadcasting and routing of audiovisual flows.

As a differential feature, Kurento Media Server also provides advanced media processing capabilities involving computer vision, video indexing, augmented reality and speech analysis. Kurento modular architecture makes simple the integration of third party media processing algorithms (i.e. speech recognition, sentiment analysis, face recognition, etc.), which can be transparently used by application developers as the rest of Kurento built-in features.

If you invested seconds of your time reading what’s Kurento, I hope you realized we ignore more and more of the internals of this world, in net terms when I came to $TWLO I felt ignorant. We sit behind our desks, monitoring prices while we trust the engineers of the companies we buy are creating new things we scarcely can imagine. This world is not ours anymore, this world belongs to those people out there that precisely created the interfaces we use to work together and we have never shaken our hands.

I really need we to understand that the greatest risk we face is not to have these companies, not precisely $TWLO, but those revolutionary names we usually hold in our portfolios. I think these companies are safe haven at least for next two years in terms of price and we should not allow sentiment to gain ground. With these companies we should not make emotional decisions.

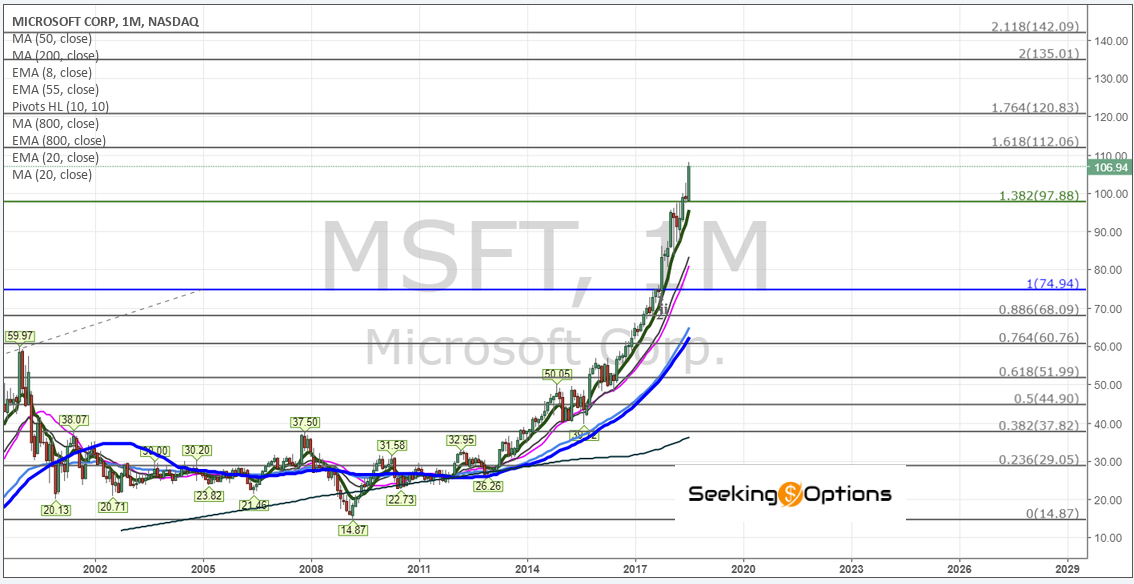

$MSFT

I have told you consistently that we measure the tape fairly well, we time the pullbacks with accuracy, current price $MSFT hit today was sent one year ago, on July 21st 2017, holding was all what we needed. So again, we have to keep in mind the very core of our business is investment in value.

Analysis:

You look at me trading around $BABA, mainly because I ignore what’s happening in Asia —India, China— but I am sure $BABA has the scale and purchasing power to take advantage of any new thing that is being invented/created in the other side of the world.

Analysis:

For $TWLO to be the company we think it is, should not break below 48.06 OPL Current 20 MA and EMA on Weekly are at 50 area. Operational extensions to the right.

$SHAK

If you want to pick a name where our patience was brutalized, that name is $SHAK. I don’t like MCD and I don’t think a very well informed generation likes MCD, but I like hamburgers and enjoy new tastes… and again management at $SHAK is the management we need/needed, focused on product and quality.

Analysis:

Analyzing $SHAK is not for anyone, trading it is, as we said, a challenge. A great great company, with 1% retrace and M-line at 53.96 . Should hold this line and get ready to challenge the all time high. Trading Shak is compared with leg days.

$ETSY

Something I missed because I did not see the real value at it’s moment, logic is simple: You want something handmade go to ETSY, you have something handmade and want to sell it, go to Etsy. Offer of products is as creative as you can imagine.

Analysis:

Needs to hold 29.11 but ideally should hold 33.85 OPL

$IQ

I have talked to you about ETSY/SHAK/TWLO… because apparently we ignore these are/were IPOs, these are companies that are offering solutions for markets, sectors are not the same for these three companies, and their road is what it is and what has been, what I made sure when entered trades into these names was that they were doing something in a way nobody had attempted in a solid way. In this sense I am sure NFLX can offer content for the Western Civilization, and I like the efforts $NFLX is doing with some good anime’s, which entices to people like me to have an account on NFLX, people bored of movies with only special effects or series that have nothing to offer after 5 episodes. And for me everything is boring, because, well, what more action or special effects do we need, we live at the brink of our seats every day: Trump, Korea, Washington, Russia, Rates, Earnings…

So in terms of Western Civilization, NFLX is good but I don’t think we can understand Chinese culture, they are a world apart, traditions, history… so we buy a company that, in my opinion, has Chinese beliefs built within them. Trading IPOs successfully is hard.

Analysis:

Support for $IQ OPL, could come at 27.16, but there is already a 1-2. We have learnt that once we establish a position we only can trade an IPO once a 1-2 is built and top of 1 is taken; in this case IQ should take 38.11 and not break below 28.94 on pullbacks, until then lower levels are likely.

I hope we learn from our experience to make money on nascent-consistent companies and not only for the purpose of making money. If we find good things we need to have the tenacity to trade wise, to be patient and to be consistent.

Anybody can buy one company at 100 and sell it for 50, so we should not be ashamed or bad about it, but TWLO from 23 to 62, SHAK from 28 to 70, ETSY from 9 to 43, we seriously, seriously must have learnt something.

I am sorry for not moving when everybody does and not feeling regret for going after what I seriously think is value and in this sense if we simply had continued trading our mature leaders are holding our just baby-borns-leaders we could have done much better.

Seeking Options Team

Seeking Options Team – RQLAB Please email us if you want to be part of this group at [email protected]

Our last report from one of our portfolio (LINK)

Again we will give more detailed trade setups and targets, please check us our Chat Room..as low as 15 dollars.. check this link for options

Access to the Trade of the Week Click Here

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Use of any of this information is entirely at your own risk, for which SeekingOptions.com will not be liable. Neither we nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness or suitability of the information and content found or offered in the material for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude liability for any such inaccuracies or errors to the fullest extent permitted by law. All information exists for nothing other than entertainment and general educational purposes. We are not registered trading advisors. SeekingOptions.com is not a registered investment Advisor or Broker/Dealer. TRADE AT YOUR OWN RISK