Indexes

Expiration: July 18th, the next three expiration constructed by Joel, are positive.

Moores’ 2C-P: Current Value at 69.0 versus 67.4 previous.

FNG-Cycles: Showing a high for today 18th /tomorrow 19th, that high certainly can extend until this Friday, July 20th due to the positive projection derived from expiration. Caution is extremely recommended on the long side.

We know how overbought stochastics are… so a fast and sudden pullback should not come as a surprise, but as a buying opportunity.

EW analysis:

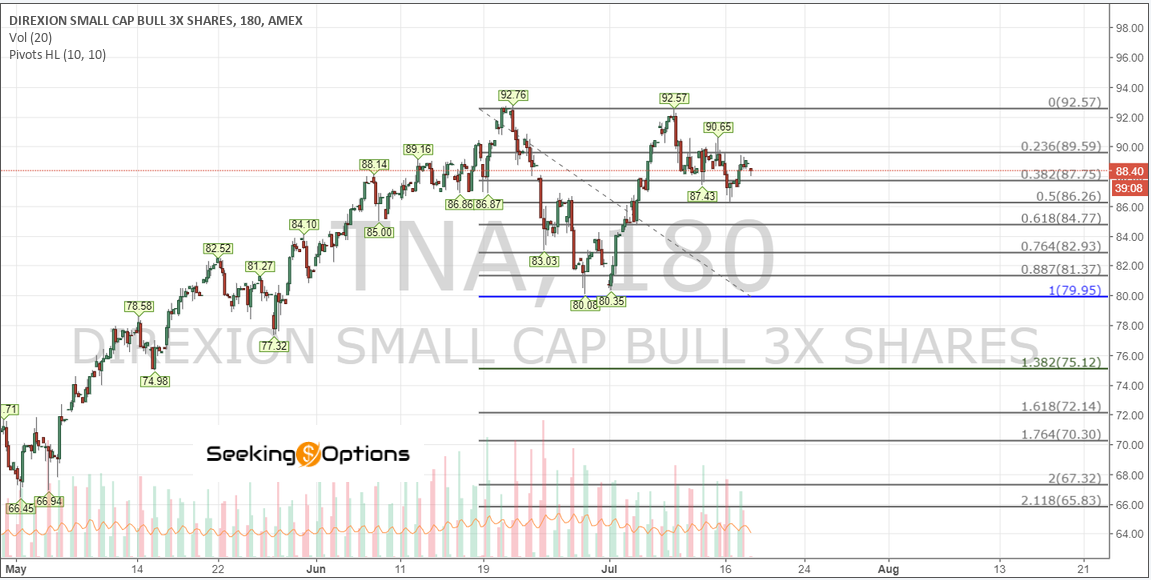

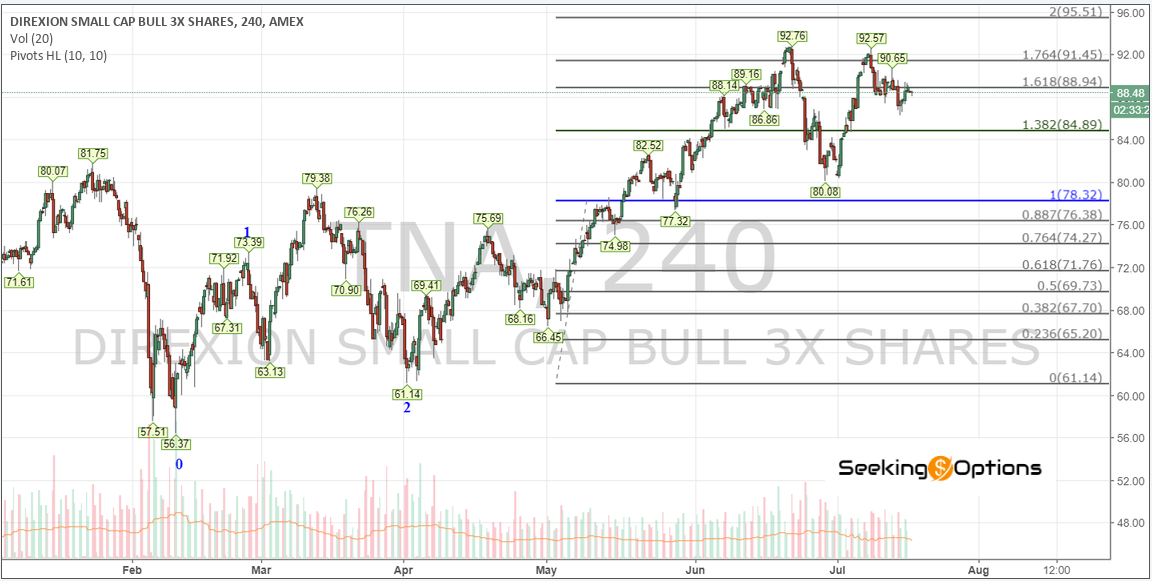

TNA

While $TNA does not exceed 92.76 an ABC pullback on Atl1M

has minimum target at 79.95 with bearish target at 70.30. $TNA been lagging as we expected. Planing two entries, I think a spike to 75.12 is buyable, understanding that another entry at 70.30 has at least 70% probabilities to occur.

$TNA should not see such deep pullback

really should hold 79.95, but extended too much versus its peers $SPX/$QQQ, so probably needs a hard reset, that in no way should invalidate targets to 99/101 area, we have avoided $TNA and we will do well by avoiding it while it does not take 92.76.

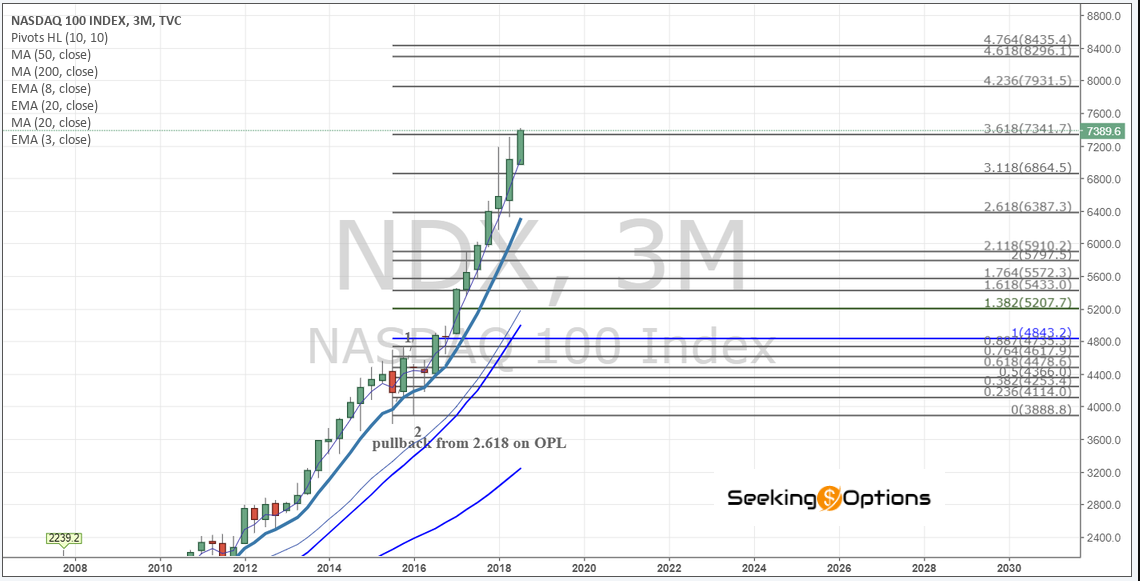

$NDX, macro extensions

Line to worry on NDX is at 8067.3, the 4.764 extension OPL

, immediate macro supports to consider are at 7341/7286.1, and we don’t see major risks while this area holds. Operative Extensions considering year 2016 pullback .

Micro for $NDX

Applying same approach on $NDX support is 7165.1 on Alt1M

this is the count we have for all indexes, where the b wave was higher than the top of 1. While wordy, is necessary to say that if 1 up off the 6950 lows, support is 7184/7129 Alt3M

and that only adds strength to the standardized approach we using on all indexes, not much difference 7165 versus 7184/7129.

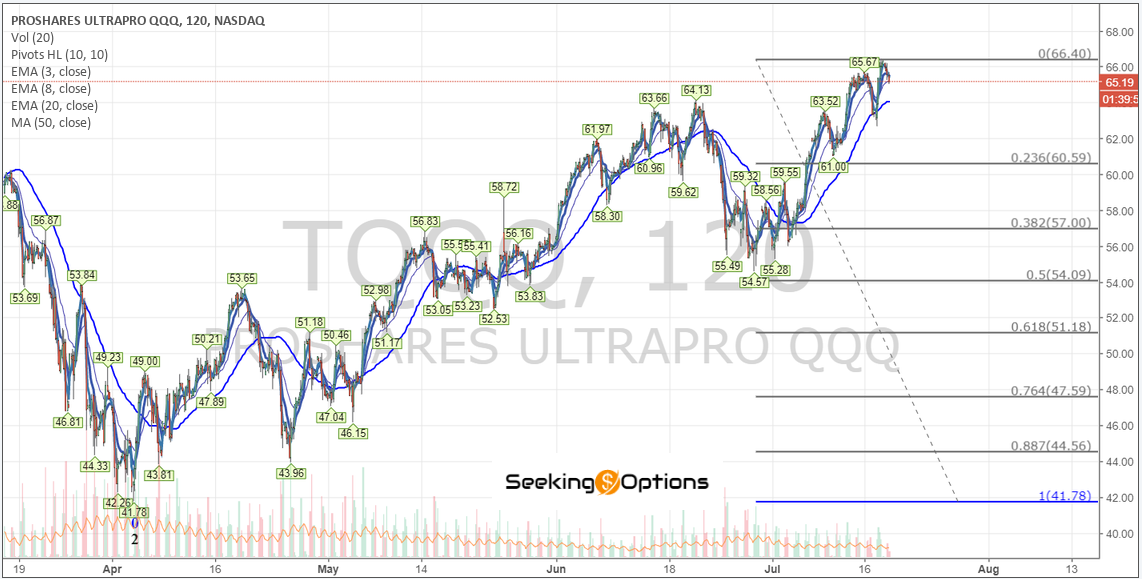

Equivalent important support for our trading vehicle $TQQQ is 60.40 Alt1M support is so precise that they overlap.

Important is to say that is necessary that $NDX breaks 6950 for we to press our accounts consistently once/if $NDX hits 6870, equivalent level of importance is 54.09 on $TQQQ Alt2M

, but I personally will re-buy any retest of 55 area, and will start repurchasing at 60.4.

So being more clear, support for NDX is 7165, equivalent to 60.40 on $TQQQ. First entry can be planned for this level. Breaking below 6950 we should buy 6870 on $NDX, equivalent to 55 on $TQQQ.

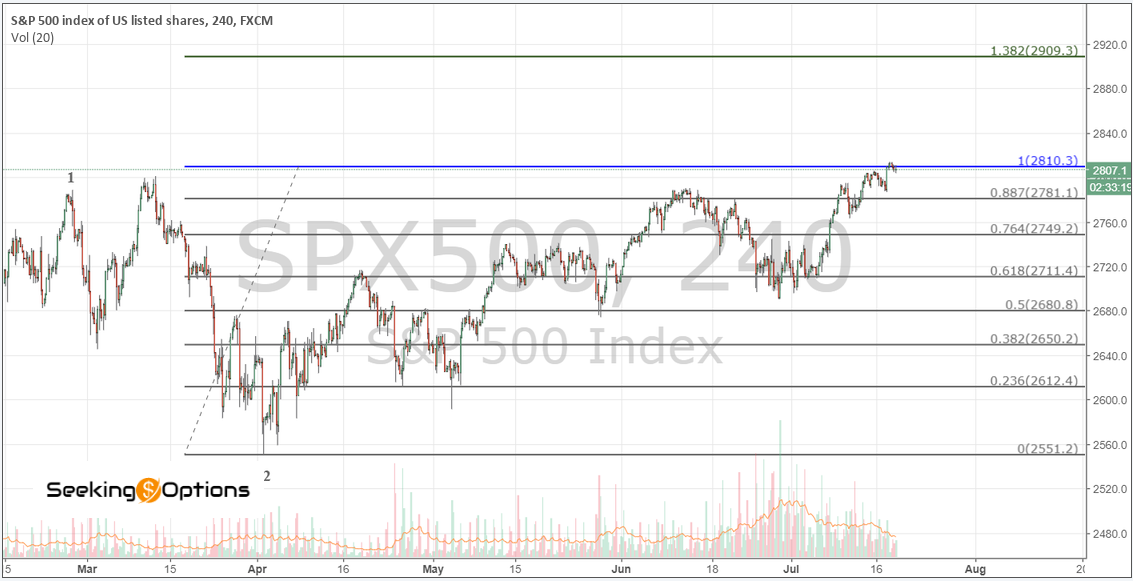

$SPX

Last but not less important, SPX Alt1M Shown in diagram:

, support at 2711, this support really needs to eat well and prepare to hold the avalanche, because if it fails things can get out of control. 200 Daily Moving average at 2685.27

Joel’s Bigalow Weekly: Weekly MA at 2716.56

Joel’s Bigalow Monthly: M-line at 2696.72, the 20 MA is at 2544.05

Baking Average of supports: 2664 for SPX and we get the standard 5% pullback we have seen through the years.

we have sent you supports for GOOGL/AMZN/AAPL/FB/NVDA/NFLX

Have to say that if our supports hold, this could be one of the best years for indexes.

Have a nice day.

Good luck

P.S These Updates were sent to our internal members if you like to receive updates right away please contact [email protected])

Our last report from one of our portfolio (LINK)

Again we will give more detailed trade setups and targets, please check us our Chat Room..as low as 15 dollars.. check this link for options

Access to the Trade of the Week Click Here

Seeking Options Team – RQLAB Please email us if you want to be part of this group at [email protected]

U.S. Government Required Disclaimer – Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Use of any of this information is entirely at your own risk, for which SeekingOptions.com will not be liable. Neither we nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness or suitability of the information and content found or offered in the material for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or errors and we expressly exclude liability for any such inaccuracies or errors to the fullest extent permitted by law. All information exists for nothing other than entertainment and general educational purposes. We are not registered trading advisors. SeekingOptions.com is not a registered investment Advisor or Broker/Dealer. TRADE AT YOUR OWN RISK