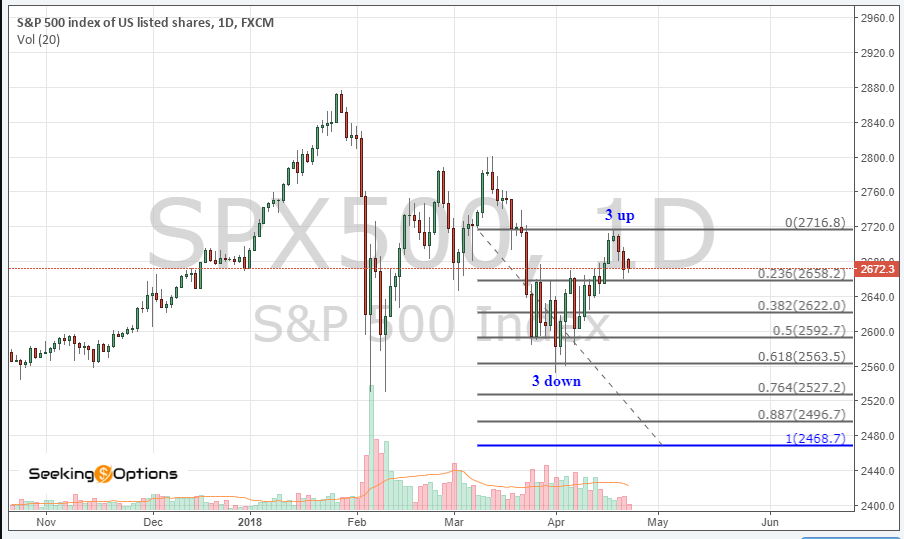

The second phase of this correction needs to be examined carefully, because the theory justifies the market should visit the 2468 area – shown in chart below:

Certainly could be much lower than that Target of 2648 on $SPX. So we need evidence from the price in order to assume the second phase will play out. We are aware of these risks and we are looking for evidence of this projection.

Other indicators like Open Interest and Cyclical analysis are pointing higher into April 27th and April 30th. Charts attached on this update. Appears to me that if pattern to the downside will play out should be after $AMZN and $FB earnings reports.

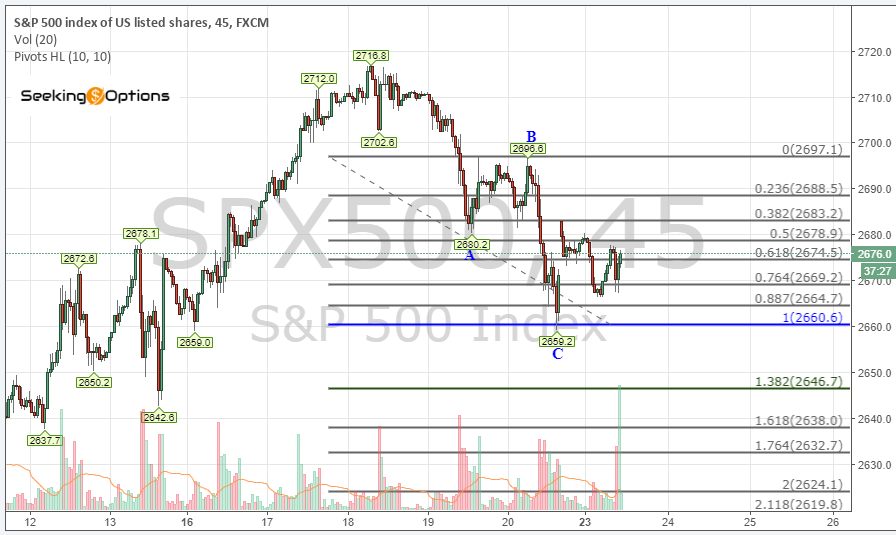

Micro charts we are monitoring reflect only three waves down from the last micro high at 2716.8 versus the 2659.2 low – as shown on next chart. So there is nothing bearish that negates the projections of the Open Interest and the Cyclical analysis. Right now 2659.2 should give us a price structure to solidify or to weaken the bearish case.

We have tried to do the best based on our analysis and we will continue to so reminding that PATIENCE is key in order to deal effectively against the dynamics of the market. Market moves fast but this does not necessarily imply you have to move fast, your capacity to monitor and process the information derived from the markets should be fast but your plan must have been designed versus the long end of what you are pursuing.