Few years ago many analysts and traders made many bearish calls against $AAPL stating that its best days are over! What did we do at Seeking Options? We believed in the story is intact and that Apple ($AAPL) can innovate, which will reflect into higher prices in the stock. With our Bullish view we have placed many trades on $AAPL in the last couple years, keeping our Core Long position.

Apple has many sources for it’s revenue starting from the iPhone taking the lead, as it has sold over 1.2 Billion Unites in its first 10 years, making it “the most successful product of all-time”, in addition to its other great category products like iPad, IPod touch, Apple Mac Family, Apple TV and Apple Watch.

Not forgetting its great balance sheet, as the company keeps on generating more great return to its long term investors. Apple qualities makes it stand the test of time against every rival “iPhone killer” that comes along. Their great IOS and Apple ecosystem that keeps people locked in, as well as the many capabilities of the iPhone and its reputation as being the premium smartphone choice. So With all that, can Apple hit the 1 Trillion Mark? Probably why not? Would it happen this year? That we don’t know.. but lets look at some Technical Charts.

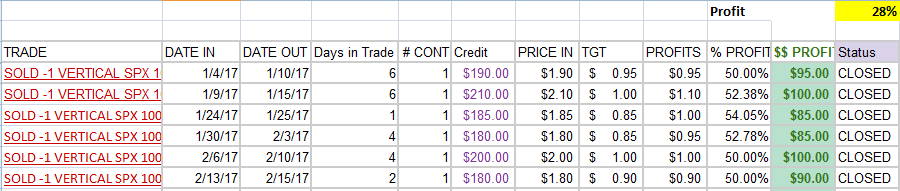

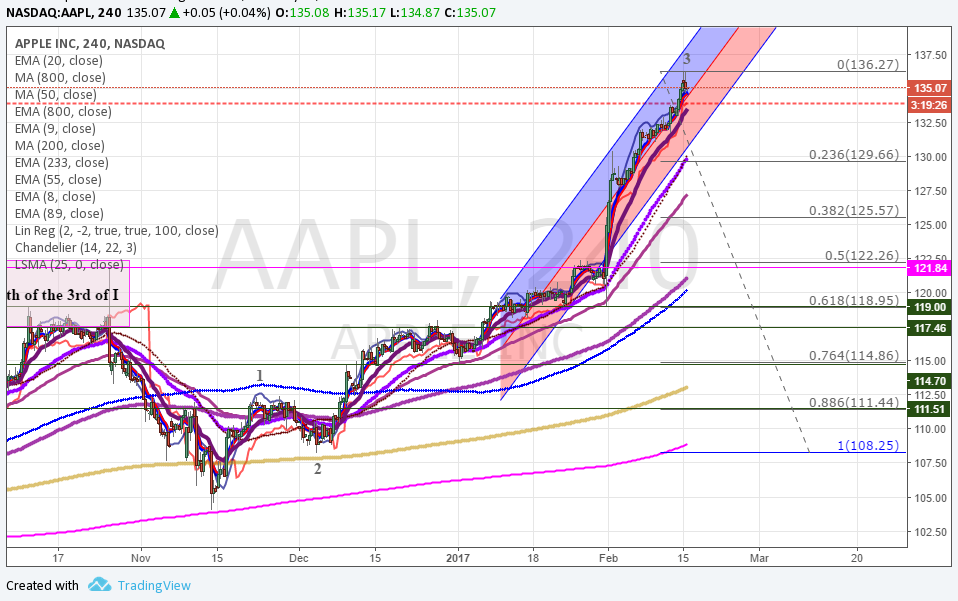

Standard support for AAPL at 125.57, max standard-acceptable support for $AAPL 122.26, as shown below

Fibonacci’s extensions proper for $AAPL

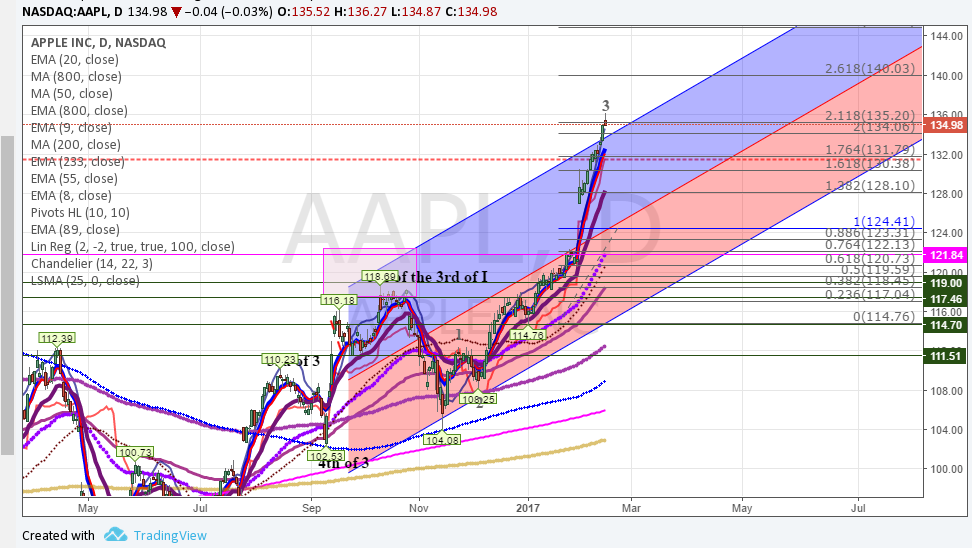

Based on its intrinsic behavior we will lower initial upper support for AAPL to 131.08 as seen on the char below and we will favor this upper support over the supports mentioned above. We will set next support for AAPL at 124.41, just let’s remind, upper support might be enough.

Next Targets

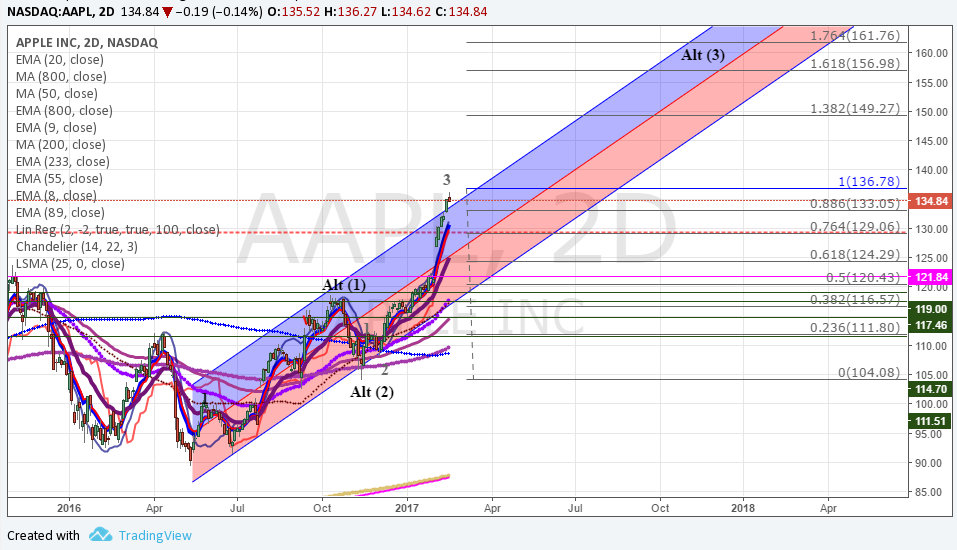

Finally but not less important, 124.29 is the alternative support on the chart below. All in all 124 area seems to be enough for all the scenarios we track but let’s not forget to add from 132 to 131 the initial position.

For targets and while 122.26 holds at a minimum 141.95 should be achieved; alternative (Alt 3) approximation points to 156.98 as reasonable probable target.

We have placed many trades in our Chat Room Feel Free to join our chat or Join our Club for more Trade Ideas.

Other Updates…

BRK.B

Standard pattern should be this (link) where the 5th of 1 should have topped at 166.50; if this the case 162.22 becomes support for wave 2 (link) and with stops at 158.61 we could expect 171 as minimum target with standard targets at 176 and 178.

If price decided to take a faster path to 172 then must hold 166.23 or .618 extension on this chart (link) in a more aggressive 1-2-3 pattern

$SPX Weekly Credit Spread Trade closed this week with 50% profit, with 28% YTD Profit 100% win trades